Guide to Key Features of a BNPL App

Are you looking to develop a BNPL app? Here we list the top features of a BNPL app that help improve the app functionality.

Buy Now, Pay Later (BNPL) apps have revolutionized the way consumers shop and pay for goods and services. With the rising demand for BNPL solutions, businesses are increasingly seeking to develop their own BNPL apps. In this guide for BNPL app development, we will explore the essential features of a BNPL app.

Firstly, let’s define exactly what is the BNPL application.

Table of Contents

What is the BNPL application?

It stands for Buy Now Pay Later (BNPL) and allows users to purchase items now but pay later. Typically, this will be done over several months or even years rather than all at once upfront, as traditional financing methods might dictate.

These payment plans help consumers feel more comfortable making purchases they otherwise wouldn’t due to the significant cost involved, which can often lead to increased sales.

A study conducted by Juniper Research expects adoption to continue growing rapidly, with estimates suggesting that nearly 900 million individuals globally will utilize these services four short years later (i.e., end of 2027). While many companies today already offer BNPL solutions, few differentiate themselves in any meaningful way from competitors.

If you are looking to jump into BNPL app development, you must know about the key features of a BNPL App.

7 Key Features of a BNPL App Which Are Must for BNPL App Development

When developing a BNPL app, several key features must be considered to ensure user satisfaction and success for both the platform and its developers. Below we outline some of the key features of a BNPL App:

1. User Authentication and Authorisation

Robust security measures should be emphasized more regarding BNPL apps, particularly user identification and credential management. Hackers often target login information to compromise user accounts, so taking steps to mitigate these risks is imperative.

When a user logs into a BNPL app, a strong password policy is essential to require users to choose complex passwords that would be difficult for attackers to guess or reverse engineer. Multi-factor authentication (MFA) is recommended, which adds another layer of protection beyond just a password.

Another option is implementing biometric recognition tools such as facial scanning or fingerprint sensors, which provide even more robust protection against potential breaches.

Sensitive data stored in databases or backups should be encrypted at rest and protected through strict access controls to limit the risk of exposure. Encryption keys used to store and transmit data between client/server endpoints securely need proper key rotation policies and regular auditing procedures to detect any vulnerabilities before they become exploited.

2. Real-time communication

While going into BNPL App Development, note that – BNPL services rely heavily on peer-to-peer technology to connect individuals seeking loans with those willing to invest capital directly without intermediaries.

These online interactions necessitate efficient communication channels enabling borrowers and lenders to exchange messages and negotiate loan agreements quickly.

Instant messaging capabilities integrated into Buy now pay later NPL apps, combined with targeted SMS broadcast campaigns, allow for smoother interactions among participants engaging in lending activities utilizing P2P technologies.

Providing live chat support options ensures seamless assistance whenever needed, alleviating frustration caused by prolonged wait times or difficulty reaching customer service representatives.

3. Escrow Service

Escrow accounts are an essential safety measure within BNPL services to protect both parties involved in peer-to-peer lending transactions. When creating these services, it’s advisable to include trustees managing the escrow accounts and holding funds until transactions conclude without disputes.

By doing so, users receive assurance their money transfers will not lead to losses resulting from fraudulent behavior or misuse of personal information shared during the transaction process. Trustees oversee account fund disbursement only after all conditions agreed upon are met, providing peace of mind to everyone engaged in direct lending activities via the platform.

Escrow accounts also reduce instances where one party might delay payment or try to cheat the system. Including them while BNPL App Development helps ensure transparent and fair dealings among community members interacting on the platform.

4. Mobile Responsiveness & Cross–Platform Compatibility

As part of the mobile application strategy outlined earlier, it’s crucial to consider designing adaptable layouts that cater to varying screen sizes and resolutions. This allows users to enjoy an optimal viewing experience irrespective of how they access the platform – through desktops, tablets, or smartphones.

By implementing responsive design techniques, developers create interfaces tailored for different display dimensions and pixel densities, making navigation intuitive and visually appealing across various device form factors.

Native app compatibility for Android and iOS devices provides greater control over performance optimization but requires significant resources dedicated solely to supporting either major operating system.

Alternatively, web applications constructed primarily using HTML, CSS, and JavaScript offer more flexibility across multiple environments accessible via web browsers. However, this approach may need to be revised when leveraging advanced functionalities exclusive to platform SDKs.

Ultimately, decisions concerning the type of app architecture to pursue should depend mainly on resource allocation and target audience preferences rather than chasing trends or market hype.

5. Payment gateway integrations

Connected payment gateway systems permit easy money transfer choices tailoring to individual financial institutions’ preferences. Adding several gateways enhances versatility, encouraging a wider pool of potential lenders and borrowers to participate in BNPL activities.

Offering multiple methods for sending and receiving funds streamlines processes, facilitating participation from clients linked to distinct bank networks or cryptocurrency wallets. Integration with popular international payment processors enables cross-border transactions, expanding global reach beyond national boundaries.

Acceptance of multiple forms of currency reduces barriers discouraging some would-be participants due to limited transaction methods available to them. Furthermore, the availability of multilingual customer support accommodates non-English speaking communities better suited for language-specific assistance throughout their lending journey within BNPL ecosystems.

6. Blockchain integration

Utilizing blockchain technology presents numerous benefits for decentralized finance (DeFi) operations. One such advantage is enhanced transparency stemming from the inherently open nature of distributed ledgers. Each node in the network possesses identical copies of the ledger, thus preventing any single entity from manipulating records undetected.

Another significant benefit involves immutability. Once recorded, data stored on blockchains cannot be altered retroactively without detection. This trait eliminates opportunities for fraudulent activity within centralized financial systems prone to human error or malicious intentions.

In summary, deploying distributed ledger technology into DeFi frameworks offers considerable advantages in terms of transparency and security unmatched by traditional banking infrastructures in BNPL App Development. These attributes empower investor confidence while reducing vulnerabilities associated with traditional financing models.

7. Graphic Reporting & Analytics

Generate informative graphs showing transaction history, spending habits, savings progress, etcetera. Implementing real-time analytics empowers users to make informed decisions about future actions and behaviors.

These core features of a BNPL App define a comprehensive set necessary to develop a functional BNPL app framework capable of meeting community expectations and requirements. As time progresses, new features emerge, adding more depth to what can be achieved on such digital financial networks.

Wrap Up

In conclusion, BNPL App Development can initially seem daunting, but with proper planning and execution, the result can be highly beneficial for your business venture.

Key features of a BNPL App to include are borrower/lender profiles containing KYC validation tools for verifying user identity details before granting access to private areas; credit scoring algorithms determining trustworthiness levels assisting lenders choosing suitable counterparties; customizable loan management dashboards promoting efficient tracking of credit history and repayment progress; auto-renewing functionality ensuring automatic roll-over of successful loans unless explicitly canceled; and flexible settings adjustments permitting fine-grain control over parameters driving BNPL activities while maximizing user satisfaction.

Collaborating with experienced BNPL app development company that can aid your project implementation success by utilizing expert knowledge to deliver quality outputs meeting industry standards.

Remember that the BNPL application refers to binary-encoded peer-to-peer lending software, which functions as an intermediary between parties engaging in personal lending transactions directly without relying upon traditional financial intermediaries.

Overall, these key components serve important roles contributing positively towards robust, secure BNPL platforms seamlessly integrating payment gateways accepting various fund transfer options connecting diverse financial institution preferences.

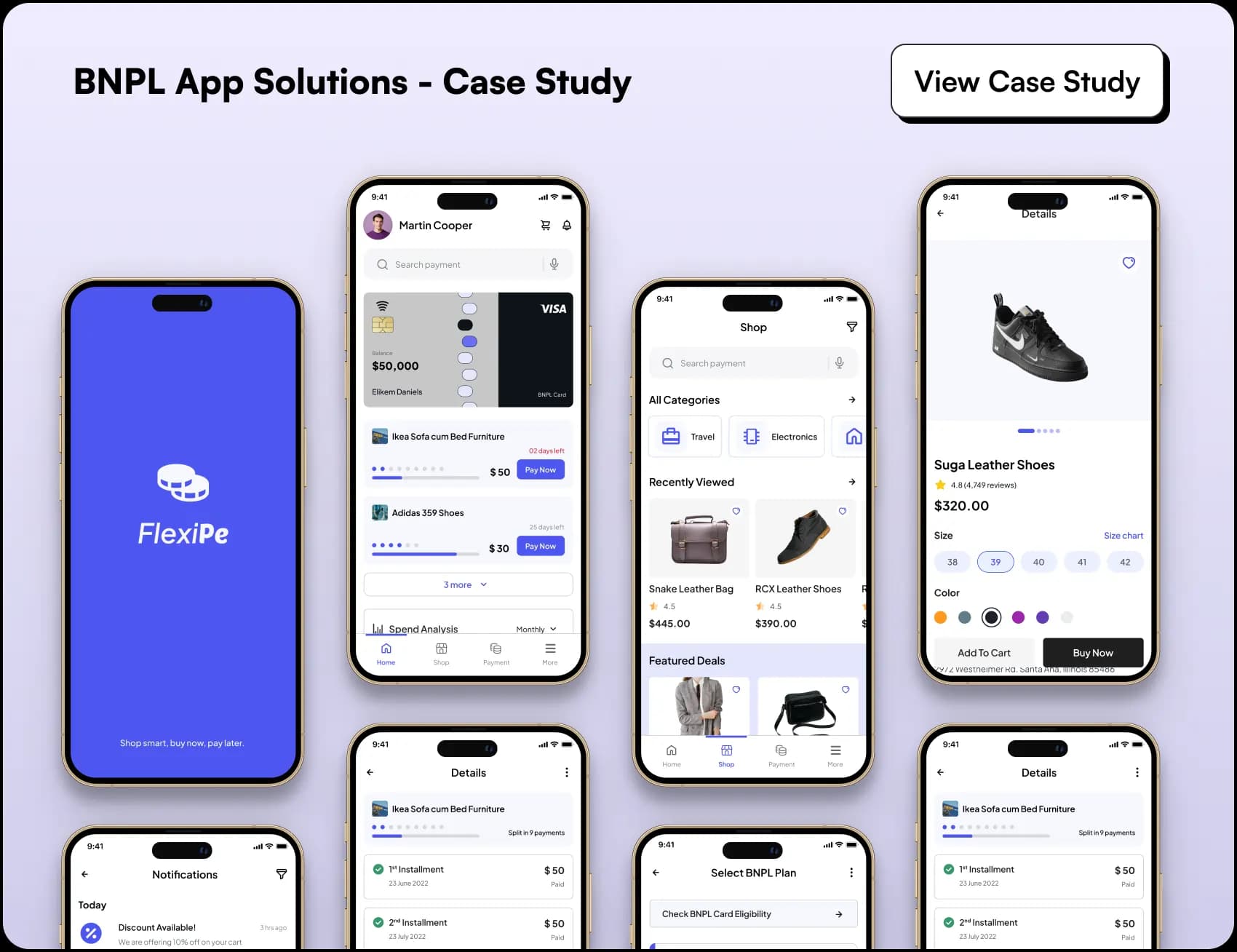

P.S. Here is how we helped Flexipe to build a revolutionary BNPL app!

FAQs

1. What exactly does BNPL stand for? And how does it differ from other types of lending applications?

BNPL stands for Binary Encoded Peer-To-Peer Lending Application. It allows individuals and organizations to borrow money from each other online without relying on traditional financial institutions such as banks. The main difference between BNPL and other lending applications is its decentralized nature. It operates independently of any third party, making it more transparent, fast, and cost-effective than traditional methods.

2. Can you explain how the KYC validation process works in relation to borrower/lender profile creation?

Customers’ identities and compliance standings are checked during the Know Your Customer (KYC) validation process before opening a P2P lending platform account. Users must give information for legal reasons to build a borrower/lender profile, such as identity papers, proof of residence, and other pertinent information. Users may sign up for the platform and begin using its features after confirming this data.

3. How can SolGuruz support companies looking to develop a BNPL platform?

SolGuruz is a reliable software development firm specializing in cutting-edge web and mobile applications. Consulting, design, prototyping, testing, deployment, training, and maintenance are just software development life cycle services we provide for the web and mobile app development projects. SolGuruz’s customers benefit from the company’s deep expertise in launching ambitious initiatives built on cutting-edge technology like Blockchain and Artificial Intelligence. Our trained developers have extensive experience in various areas, enabling them to tackle projects of varying complexity from the ground up, delivering fully working, client-specific solutions.

From Insight to Action

Insights define intent. Execution defines results. Understand how we deliver with structure, collaborate through partnerships, and how our guidebooks help leaders make better product decisions.

Launch Your BNPL App

Implement key features that make your BNPL app a market leader with SolGuruz's development expertise.

Strict NDA

Trusted by Startups & Enterprises Worldwide

Flexible Engagement Models

1 Week Risk-Free Trial

Give us a call now!

+1 (724) 577-7737