How to Build a BNPL App Like Klarna in 2026? (Steps Shared)

Building a BNPL app like Klarna means creating a credit-driven product, not just a payment feature. BNPL app development can improve reach, boost conversions, and drive repeat purchases, but it also introduces credit risk, compliance requirements, and operational complexity that must be managed carefully.

Here’s the thing about building a BNPL app like Klarna: you’re not just adding a “pay later” button.

You’re building a credit product. One that needs to assess risk in real-time, manage repayment schedules, integrate with merchants, and stay compliant with financial regulations—all while keeping users coming back.

Many founders see the success of Klarna, Affirm, and Afterpay and think, “We should build one of these.”

And honestly? It makes sense. The market’s proven. Users love the flexibility. Merchants see higher conversions.

But here’s what catches most teams off guard: building BNPL is fundamentally different from building a wallet or payment gateway. You’re not just moving money around. You’re extending credit, managing default risk, and making split-second decisions about who qualifies and who doesn’t.

The questions that matter most aren’t about UI design or checkout flows; they’re about eligibility logic, repayment structures, revenue models, and how you’ll handle the inevitable missed payments without tanking your unit economics.

This guide is for product teams and businesses seriously considering making a BNPL app like Klarna.

We will break down how these apps work behind the scenes, how a payment app like Klarna differs from traditional payment solutions, and what you need to get right before you write a single line of code.

Table of Contents

What Is a BNPL App Like Klarna

A BNPL app like Klarna allows users to split a purchase into multiple payments over a fixed period while the merchant receives the full amount upfront. The platform assumes the credit risk and earns revenue from merchant fees, late payment charges, or a combination of both.

At its core, this is not just a payment experience. It is a short-term credit system embedded into checkout. Every transaction involves real-time eligibility checks, risk assessment, repayment scheduling, and post-purchase monitoring.

That is what separates a BNPL product from a traditional wallet or card-based flow.

A payment app like Klarna does not simply process money.

It decides →

- whether to extend credit

- how much credit to extend

- And under what terms

Who Should Consider BNPL App Development

BNPL app development makes sense only for teams that are prepared to build and manage credit as a product, not just a feature.

This model is well-suited for 👇

- Fintech startups building consumer credit or lending products

- E-commerce platforms looking to increase conversion and order value

- Marketplaces that want tighter control over checkout and payments

- Enterprises exploring embedded finance as a revenue stream

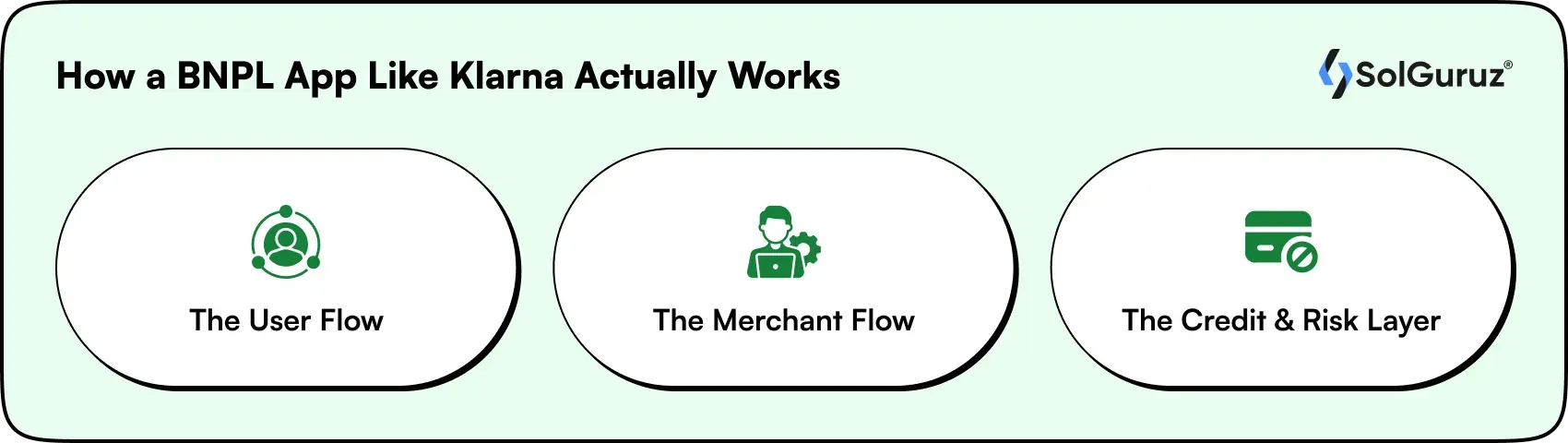

How a BNPL App Like Klarna Actually Works

A BNPL application like Klarna handles complexity behind the scenes while keeping checkout simple for users.

That single “pay later” button triggers several systems at once, like →

- Credit checks to verify eligibility

- Risk scoring to assess default probability

- Payment processing to authorize the purchase

- Merchant reconciliation to settle funds

All of this happens in seconds,

And the entire flow can be broken down into three core layers 👇

- the user journey

- the merchant interaction

- the credit decision engine

1) The User Flow:

From a user’s perspective, the experience is intentionally frictionless.

It can →

- The user selects a BNPL option at checkout

- The system evaluates eligibility in seconds

- The purchase is approved or declined instantly

- The user completes the order and repays in scheduled installments

What makes this possible is real-time data analysis.

A BNPL app like Klarna evaluates user behavior, transaction history, device signals, and repayment patterns before approving a purchase. The goal is to reduce friction while keeping default risk under control.

2) The Merchant Flow:

For merchants, the experience is designed to feel like a standard payment method.

- The merchant integrates the BNPL option into checkout

- The platform approves the transaction on behalf of the user

- The merchant receives the full payment upfront

- The BNPL provider handles repayment and risk

This is where a payment app like Klarna differs from traditional payment gateways. The merchant does not carry credit risk. That responsibility shifts entirely to the BNPL platform.

3) The Credit and Risk Layer:

This is the most critical part of BNPL app development, and the area most teams underestimate.

Behind every approval decision are systems that →

- Calculate eligibility limits in real time

- Adjust risk based on user behavior and repayment history

- Detect fraud and abnormal patterns

- Trigger reminders, penalties, or collections if payments are missed

When making a BNPL app like Klarna, these systems must work reliably at scale.

Poor risk logic can quickly lead to high default rates, while overly strict rules can hurt approval rates and user adoption.

The success of a BNPL product depends on striking the right balance between growth and risk from day one.

How is BNPL app development different from building a payment app

At first glance, a BNPL app like Klarna can look similar to a regular payment solution. Both appear at checkout. Both help users complete a purchase but under the hood, the two models are fundamentally different.

A traditional payment app focuses on moving money. On the other hand a BNPL product focuses on extending credit:

|

Aspect |

BNPL App Like Klarna |

Traditional Payment Apps |

| Core purpose | Extends short-term credit at checkout | Processes immediate payments |

| Credit decision | Evaluates user eligibility in real time | No credit evaluation involved |

| Risk ownership | The platform carries default and repayment risk | No long-term financial risk |

| User payment | Split into scheduled installments | Paid in full at checkout |

| Merchant payout | Merchant receives the full amount upfront | The merchant receives payment after the settlement |

| Revenue model | Merchant fees, late fees, financing margins | Transaction or processing fees |

| Post-purchase involvement | Manages repayments, reminders, and collections | No involvement after payment |

| Compliance requirements | High, including lending and credit regulations | Lower, focused on payments only |

| System complexity | Requires underwriting, risk models, and monitoring | Focused on transaction processing |

| Business model impact | Ongoing exposure per transaction | One-time transaction lifecycle |

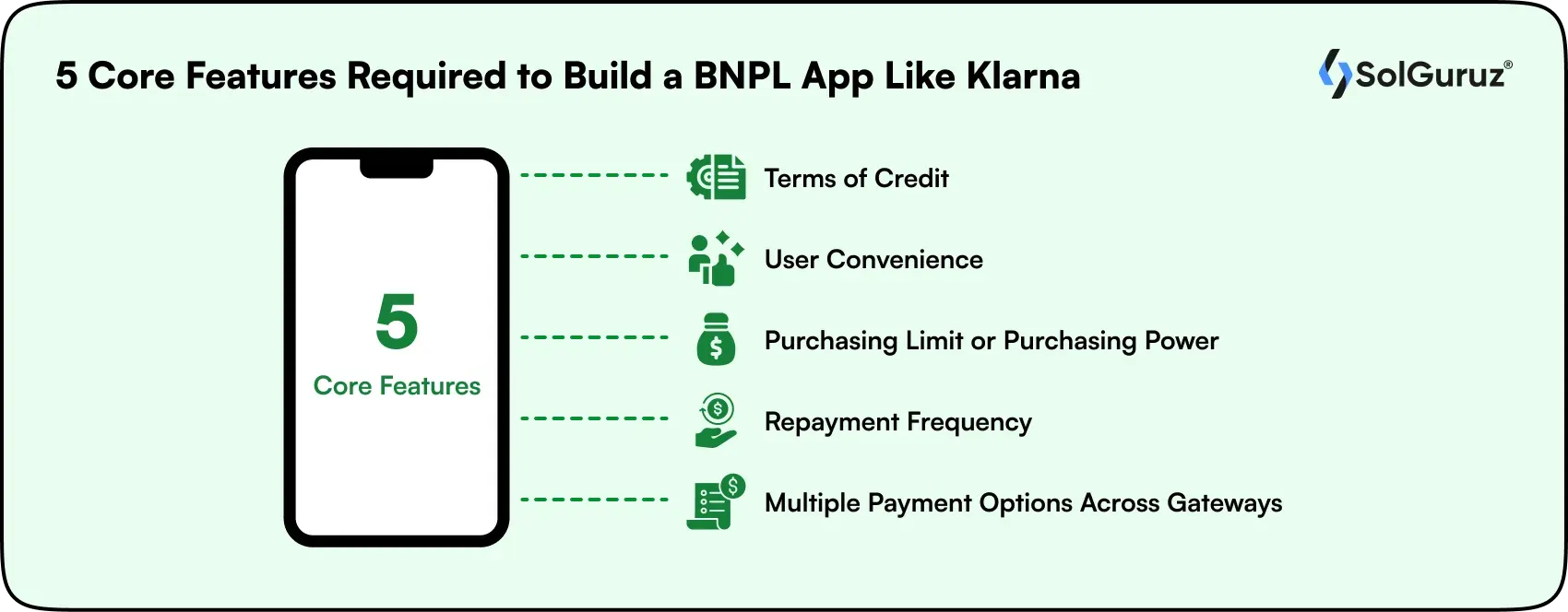

5 Core Features Required to Build a BNPL App Like Klarna

As we have understood BNPL apps, now it is time to add features to your app. When developing a buy-now-pay-later app, keep in mind features such as a repayment facility and user convenience that shape the user experience. Other features to add to your BNPL app can be:

While feature depth can vary by market and regulation, the following capabilities are essential for successful BNPL app development.

1. Terms of Credit

Credit terms define how users repay their purchases and how risk is distributed. A BNPL app like Klarna typically offers multiple repayment options, with Pay in 4 being the most common.

Users may be allowed to:

- Split payments into four equal installments

- Pay after a fixed number of days

- Choose longer repayment periods based on eligibility

Flexible credit terms improve adoption while allowing the platform to adjust exposure based on user behavior.

2. User Convenience

User convenience is a core reason BNPL apps outperform traditional credit products. Instant approvals remove the friction associated with loans, applications, and manual verification.

Unlike conventional lending, a payment app like Klarna enables users to:

- Complete purchases without lengthy forms

- Receive instant eligibility decisions

- Repay through simple scheduled installments

This ease of use plays a major role in repeat usage and customer loyalty.

3. Purchasing Limit or Purchasing Power

Purchasing limits determine how much credit a user can access at any given time. In a BNPL app like Klarna, these limits are not fixed. They are evaluated dynamically based on multiple factors.

Common inputs include:

- Past repayment behavior

- Transaction history

- Risk signals and spending patterns

Some BNPL platforms allow limits up to 20000 dollars for eligible users, while others scale limits gradually to reduce default risk.

4. Repayment Frequency

Repayment frequency defines how often users are expected to make payments. Most BNPL apps allow users to repay through weekly or monthly installments while merchants receive the full amount upfront.

This structure benefits both sides:

- Users get manageable payments

- Merchants avoid delayed settlements

From a platform perspective, repayment schedules must be tightly integrated with reminders, penalties, and support workflows to reduce missed payments.

5. Multiple Payment Options Across Gateways

BNPL apps must support a wide range of payment methods to ensure smooth repayments. Relying on a single gateway limits reach and increases friction.

A well-designed BNPL app integrates:

- Credit and debit cards

- Digital wallets

- Bank transfers

Supporting multiple gateways improves accessibility and reduces repayment failures across different user segments.

Features like flexible payment plans, tracking purchases, interest rates and fees, customer support, security, and integration with ecommerce are explained in detail in the exclusive blog Guide to Key Features of BNPL Apps.

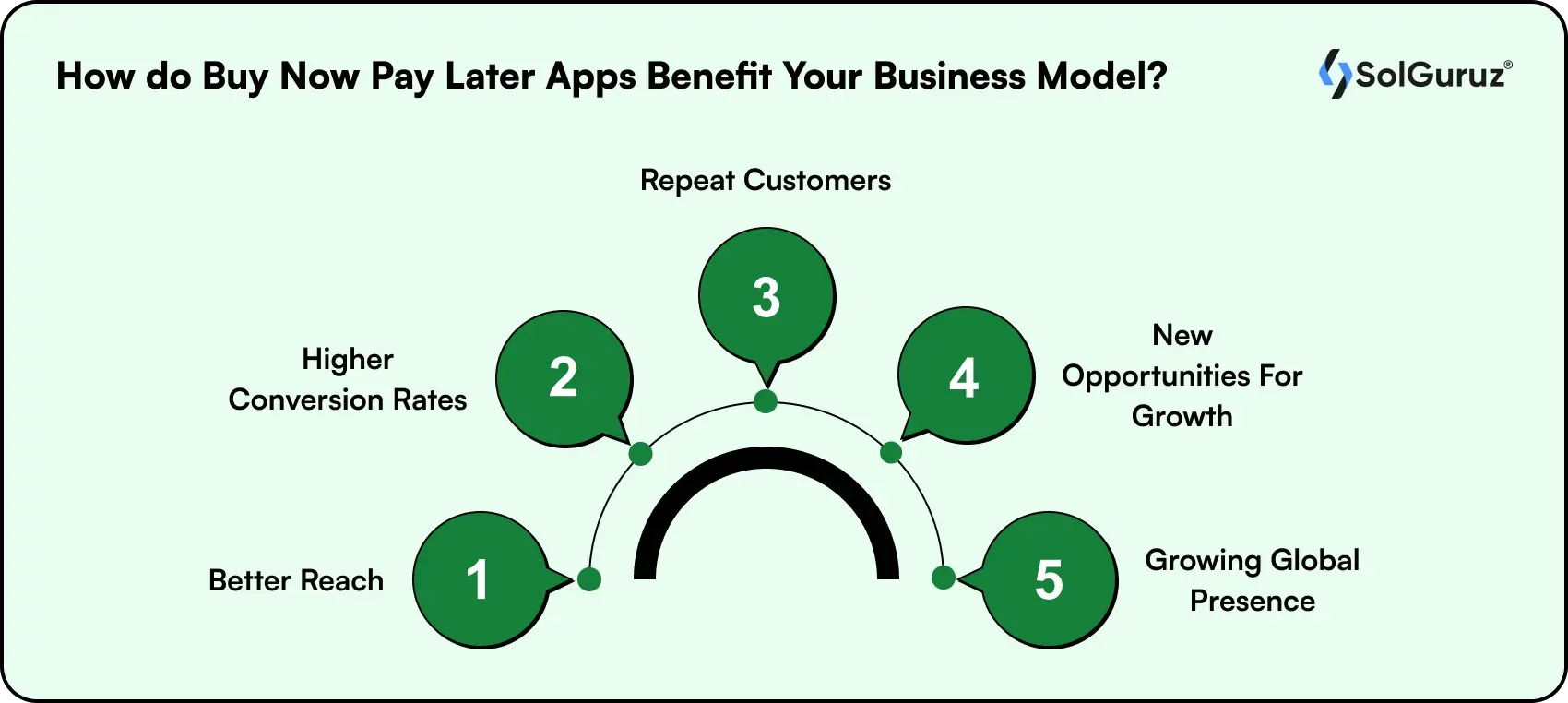

How do Buy Now Pay Later Apps Benefit Your Business Model?

Building a BNPL app like Klarna is not only a product decision. It is a business model decision that directly affects reach, revenue, and customer behavior.

Why?

Because the BNPL adoption has grown rapidly across Europe, Australia, and New Zealand, with strong momentum in North America as well. As young users, especially Millennials and Gen Z, actively prefer payment apps like Klarna.

Especially when shopping online, particularly in categories such as apparel, accessories, and lifestyle products.

For businesses, BNPL app development unlocks several measurable advantages.

1) Better Reach

BNPL apps help businesses reach customer segments that are otherwise hesitant to complete purchases.

By offering a BNPL option at checkout, brands can attract users who →

- Delay purchases due to upfront cost concerns

- Prefer instalment-based payments over credit cards

- Actively seek out merchants offering pay-later options

This expanded reach is especially effective for fast-moving consumer categories and trend-driven markets.

2) Higher Conversion Rates

One of the most immediate benefits of a BNPL app like Klarna is improved conversion.

Flexible payments reduce purchase friction and make higher-value items feel more accessible. As a result, businesses using BNPL options often see conversion rate increases ranging from 20 to 30%.

The psychology is simple. When the upfront cost feels manageable, users are far less likely to abandon their cart.

These benefits are not theoretical. You can see how BNPL app development translated into real business outcomes by exploring this BNPL app development case study.

3) Repeat Customers

BNPL apps are designed to encourage repeat usage. Simple repayment flows, transparent schedules, and rewards create a positive post-purchase experience.

Users who complete installments successfully are more likely to:

- Return for future purchases

- Increase order frequency

- Develop trust in the platform and brand

This makes BNPL app development a powerful driver of customer lifetime value, not just one time sales.

4) New Opportunities for Growth

Investing in a BNPL product opens doors beyond checkout optimization.

- Businesses gain the ability to:

- Launch loyalty programs tied to repayment behavior

- Offer personalized credit limits

- Experiment with new pricing and promotion models

For companies willing to innovate, building a BNPL app like Klarna can position them as leaders rather than followers in the payment space.

5) Growing Global Presence

BNPL services now operate across multiple continents, such as the United States, Europe, India, Australia, etc.

This global adoption signals one thing clearly. BNPL is no longer a regional trend. It is a mainstream payment and credit model with long-term relevance.

For businesses planning international expansion, a BNPL app like Klarna can act as a strong enabler for entering new markets with localized payment flexibility.

A detailed blog on the “Top Buy Now Pay Later Apps” covers all the popular buy now pay later apps that are customers’ top choices.

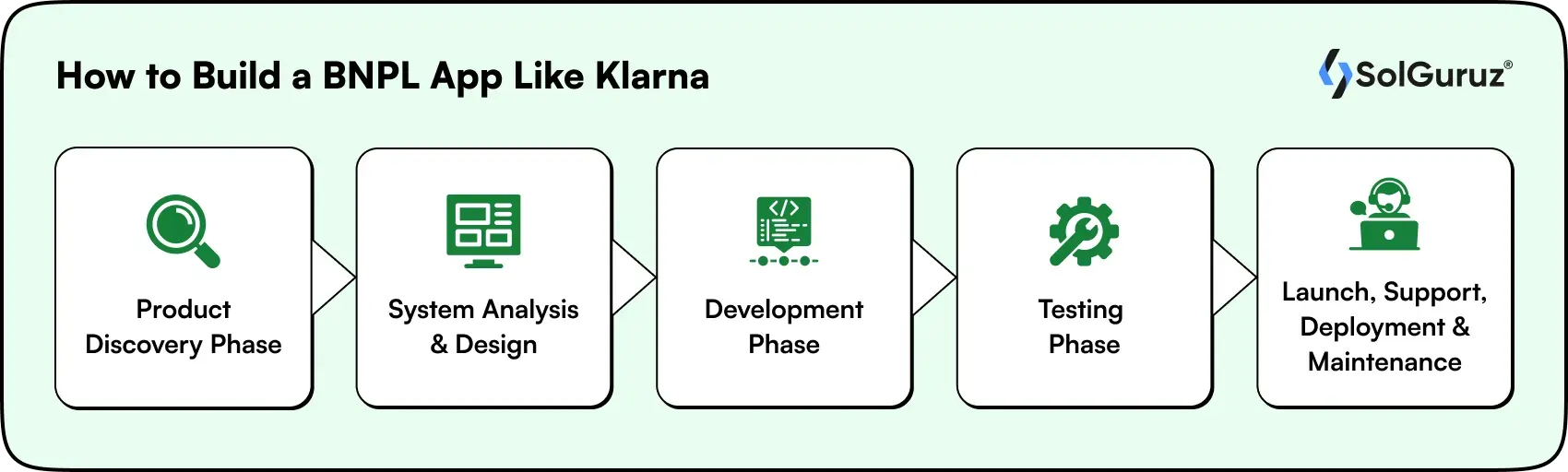

Let’s Get To The Core: How Do You Develop A BNPL App Similar to Klarna?

While developing any BNPL app like Klarna, you need to make sure to follow the steps to development, the budgeting while developing, knowledge of the tech stack, and the required tools for the development phase. Let us start with the steps to develop.

How to Build a BNPL App Like Klarna

- Product Discovery Phase

- System Analysis & Design

- Development Phase

- Testing Phase

- Launch, Support, Deployment & Maintenance

1. Product Discovery Phase

Any business idea always requires initial planning and information gathering. It becomes imperative to understand the market trends for the idea, in this case, a BNPL app like Klarna. Here, you need to understand your target audience, their purchase behavior, patterns, and the budget range; you will have to play in between that range to be a success.

The following vital thing is competitor analysis. When you understand what the competitors are offering, then you can identify what values your brand will bring to the table and what solutions it will offer. All the information gathering helps you draw out a rough outline. The information lays out a conceptualization of your application, which can be developed as an MVP and finally transformed into a distinct product.

Let’s summarise a few points:

- Researching Market Trends

- Customer Purchase Patterns and Behavior

- Target Audience

- Conceptualization

- Value Offering and Problem Solution

It is wise to develop your MVP in the initial stage to get faster time to market. Consult MVP development services to get your BNPL MVP and step into the market with a bang.

2. System Analysis & Design Experience

This step is about identifying the gaps between the ideation and conceptualization processes. It is about going deep into the system software. This step comes when you have mapped out the system requirements.

Deciding the UX/UI of your product/solution can never be an afterthought. It is in this phase you work with designers to finalize the look and feel of the product. The color palette, overall theme, aesthetics, and other things help reduce the conflicts later.

3. Development Phase

To fully understand the operational and financial implications, it helps to break BNPL app development into clear execution stages, which we have explained in detail in our guide on steps to develop a buy now pay later app.

4. Testing Phase

Once the development and coding are done, the testers come into the picture. Testers and QAs work on the completed project so they can test the application for any bugs. Any bugs in the application or any glitches while using the application are reported as issues and given back to the developers to sort them. Again, the app is tested and checked for bugs. Once testers and QA tests the buy now pay later software, it is ready for the deployment phase.

5. Launch, Support, Deployment, & Maintenance

After the code development and bug detection comes the launch of the buy now pay later app. After launch, the app is available on the respective platforms for customers. Customer feedback is incorporated to make the app better and to ensure a seamless user experience. Post-launch maintenance not only upgrades the product but also keeps you updated with the latest ongoing trends. You can ask the buy now pay later app development company while discussing whether or not they provide post-launch support.

What is the Cost of Developing a BNPL App like Klarna?

Listed below are factors that influence the cost of a buy now, pay later app:

- Features of the product

- Design of products

- Cost of the development team

- Project magnitude and complexity

- Technology stack

- Number of project members

- Duration

The main element influencing a project’s cost is the hourly rate of developers. It varies depending on where you hire the developers. For instance, if you hire mobile app developers in India, the cost to develop a BNPL application is around $40,000-70,000. But for the same app to be developed in the USA, the cost might rise to $150,000-300,000 in the USA. A simple reason for this is the cost of living standards vary from place to place. There might be a difference in cost between an Indonesian developer and a Swedish developer.

Prerequisites for Development – Tech Stack

A robust tech stack will provide a solid basis for your Fintech BNPL app. Choosing the right technology stack is essential. The essential technologies for your Fintech application are listed below. Let’s find out:

| Platform | Tech Stack, Tools, and Frameworks |

| Native App Development | Kotlin, Objective C, Swift |

| Hybrid App Development | React Native and Flutter |

| Frontend | Angular Or React JS, Typescript |

| CMS | Strapi, Storyblok, Contentful |

| Backend | Java, Python, .NET, Node.js |

| Database | MongoDB, PostgreSQL or MySQL for data storage. |

| Cloud and DevOps | AWS, Azure, Google Cloud, Docker, Kubernetes |

| Analytics | MixPanel, Google Analytics |

| Notifications | Firebase, One Signal |

| Code Review and CI/CD | SonarQube, Codemagic, Gitlab, GitHub, BitBucket |

| Payment Gateway | Stripe, Braintree, PayPal, Razorpay |

| Modern Tools | Generative AI, OpenAI, Large Language Models, Machine Learning |

How can AI and ML be Implemented in Buy-Now-Pay-Later App Development?

AI and machine learning (ML) hold significant potential in revolutionizing Buy Now Pay Later (BNPL) app development, offering innovative solutions to enhance user experience, mitigate risks, and drive business growth.

Credit defaulting is a significant challenge that the BNPL industry is suffering. Many users take loans from multiple BNPL apps and don’t repay the debt. Hence no debt-recovering mechanism. Here, AI can be of great help in developing a recovery mechanism. By analyzing user behaviors and applying ML algorithms, AI can help assess creditworthy candidates, assist BNPL in identifying potential defaulters, and take checking measures at the correct time. Another great way to ensure your buy now pay later software is in safe hands is to hire mobile app developers who have pro skills in integrating AI with fintech apps.

Among other benefits of integrating open AI in mobile app development is you can enhance user engagement and retention in BNPL apps through personalized recommendations and predictive analytics. By analyzing user interactions and transaction data, machine learning algorithms can anticipate user needs and preferences, delivering targeted promotions, product recommendations, and reminders tailored to individual users’ interests and buying habits.

Moreover, AI-powered chatbots and virtual assistants can provide real-time customer support and human-like query resolution. AI-powered chatbots can guide the customers regarding the BNPL app queries or issues and resolve them to better the user experience.

How Can SolGuruz Help You Develop a BNPL App Like Klarna?

SolGuruz is your trusted partner in developing a Buy Now Pay Later (BNPL) app like Klarna, offering expertise, experience, and innovation to bring your vision to life.

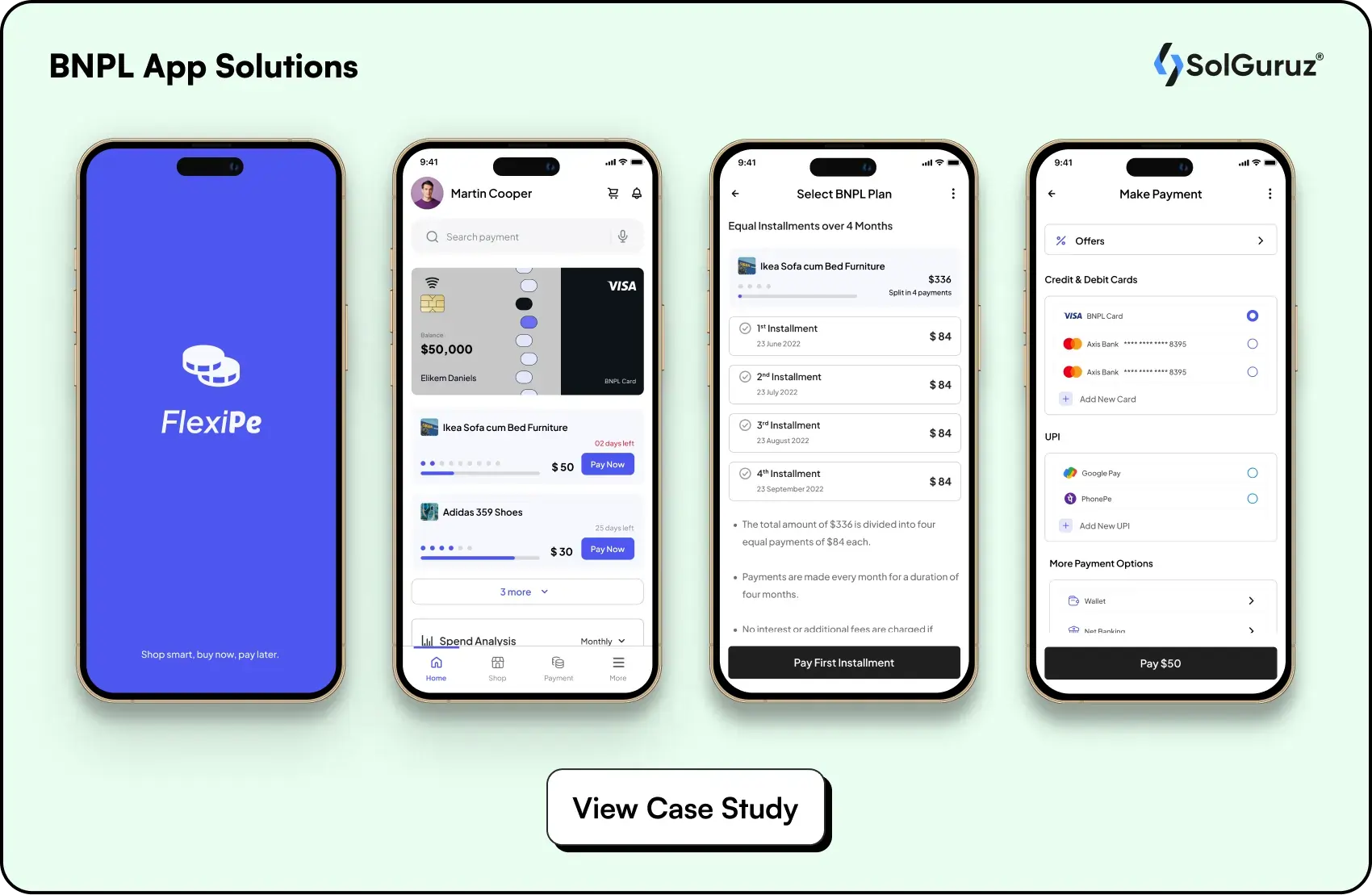

SolGuruz understands that businesses with unique demands require unique solutions. To develop a tailored solution, our team works on intricate details to provide a solution that aligns with your business goals and caters to the target audience. Check out the journey of FlexiPe.

With a team of skilled developers and engineers, SolGuruz has extensive experience in leveraging the latest technologies to build robust and scalable applications. From frontend frameworks to backend infrastructure and payment gateways, we ensure that your BNPL app is built on a solid foundation that can handle the demands of a growing user base.

SolGuruz ensures that launch and maintenance support keeps the application updated and well-secured against current challenges while striving for optimum performance.

Conclusion

BNPL is a win-win situation with all the parties involved. With growing global consumerism and rising demands from customers, the market is revolving around affordability. BNPL apps like Klarna, with their flexibility and convenience, make affordability easy and, with seamless customer experience, these apps lead the competition game.

If you are planning to get a BNPL app, then always shake hands with the experts in the field. A buy-now-pay-later app development company like SolGuruz has proven experience with integrating generative AI services and supercharging your app to great success.

FAQs

1. What are other examples of buy now, pay later apps?

The BNPL market is very competitive. Other prominent players like Afterpay, Affirm, and Zilch have a presence in the global market.

2. What are the different repayment facilities that BNPL apps provide?

There are different modes of payment available. Customers can quickly pay via credit cards or bank transfers to pay for the repayment. Availing of many options provides convenience but also requires security to safeguard sensitive information.

3. How does the Buy Now Pay Later App Development Implement Privacy?

Securing the financial transactions gives the customers a sense of trust. It is important to secure payment integrations. Safety measures like two-factor authentication and SSL encryption can make the security more robust.

4. Do eCommerce sites integrate BNPL apps?

Yes. Many e-commerce sites or platforms enable this option. It becomes convenient for the customer and is suitable for business. This is a win-win situation as the BNPL apps and e-commerce sites both earn commissions.

5. How do BNPL apps utilize AI/ML to provide personalized experiences?

Some of the ways in which you can utilize AI/ML – using AI-powered chatbots, AI-powered virtual assistants, generative AI services, prompt engineering to get the best of the user experience, and implementing advanced technologies to supersede the competition.

From Insight to Action

Insights define intent. Execution defines results. Understand how we deliver with structure, collaborate through partnerships, and how our guidebooks help leaders make better product decisions.

Launch Your BNPL App

Explore how to develop a BNPL app that competes with the best like Klarna. Our team can help you build it.

Strict NDA

Trusted by Startups & Enterprises Worldwide

Flexible Engagement Models

1 Week Risk-Free Trial

Give us a call now!

+1 (724) 577-7737