Cost to Develop a BNPL App Like Affirm in 2026: Easy Breakdown for You

Buy Now Pay Later apps like Affirm are changing how people shop worldwide. If you want to build your own BNPL product, cost is the first question. This guide explains the total cost to develop a BNPL app like Affirm, the must-have features, timeline and how SolGuruz can help you launch confidently.

Well, this is a complete friendly guide for founders, even if you are new to fintech.

Let’s be honest.

We all love convenience. When a customer sees something they like online, they don’t always want to wait for payday. With BNPL, they don’t have to.

That is exactly why apps like Affirm, Sezzle, and Afterpay exploded in the market.

People get easy installments. Merchants get more sales. It is a clear win-win.

Now, if you are reading this, you are probably thinking

“Can I build something like Affirm for my market?”

And “How much will this actually cost me?”

Let me share all the answers in a very simple guide that is easy to understand.

Table of Contents

Why BNPL Works So Well (2026 & the Future)

Imagine a user shopping for shoes. They love the pair. But the price feels heavy today. So they leave the cart.

BNPL prevents that. It says, “You take it now. Pay bit by bit. No stress.”

So what exactly happens:

✔ More purchases happen instantly

✔ Customers return more often

✔ Average order value increases

✔ Businesses get better retention

✔ Users feel trusted and empowered

The market is growing fast. If you enter now, you are ahead of many future competitors.

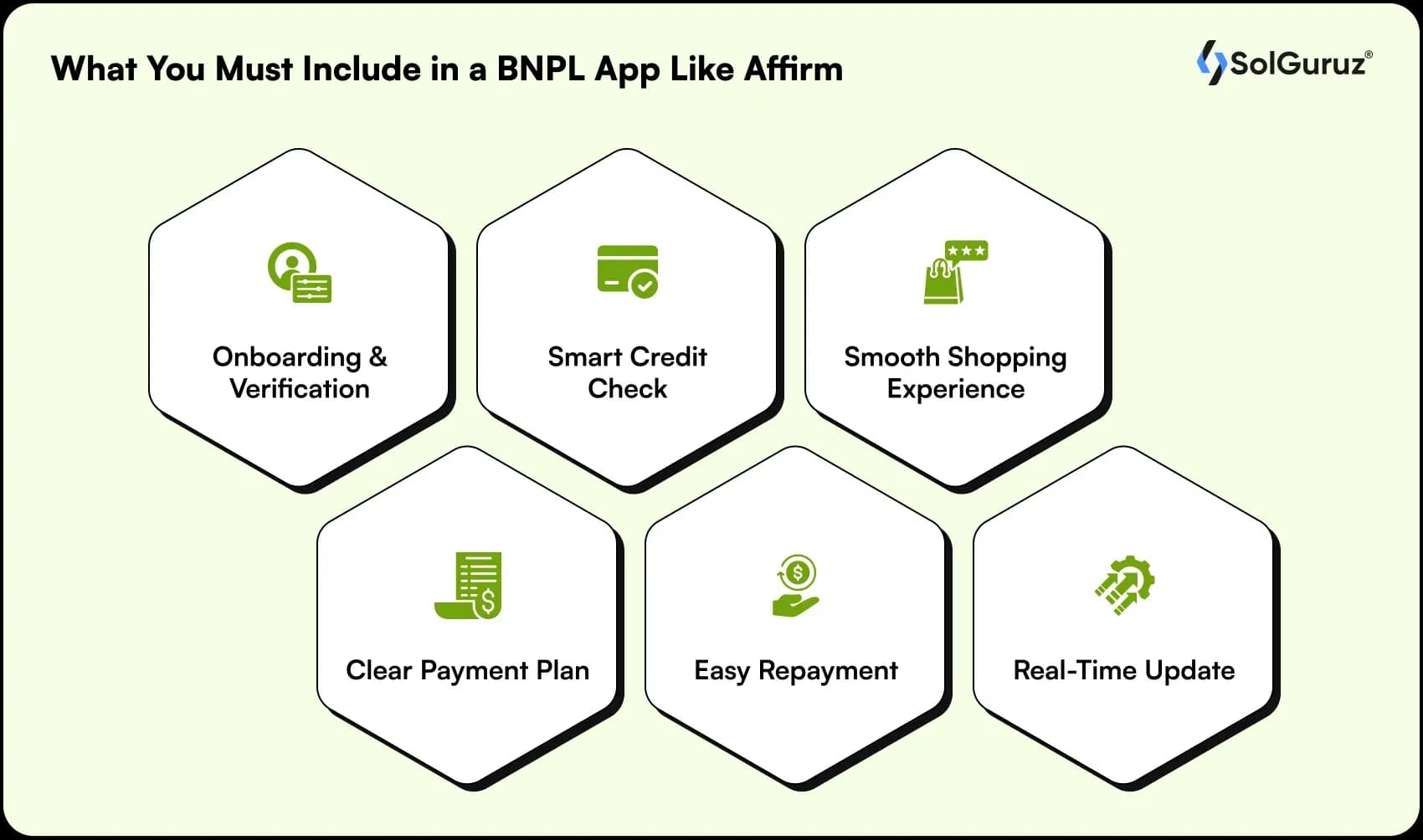

What You Must Include in a BNPL App Like Affirm

A BNPL app has one core purpose: to give credit quickly and safely.

If security or trust is low, users will run away. So your app needs features that make people feel safe and in control.

Whether you’re building a fintech application or planning to integrate BNPL features into an existing app.

Let’s look at them in a simple flow:

Step 1: Onboarding and Verification

Users should sign up in minutes. KYC must confirm identity. A BNPL platform deals with money. So fake accounts are a big risk.

Tell the user clearly, “We verify to protect you and approve you faster next time.”

Step 2: Smart Credit Check

This decides how much a user can spend. Good credit experience helps them shop again confidently.

You can start simple and improve with AI later.

Step 3: Smooth Shopping Experience

Let users browse partnered stores or shop anywhere through integrations.

If checkout feels slow or confusing, they will drop you for another app.

Step 4: Clear Payment Plan

Well, there should be no hidden terms. No surprises. Tell your users directly that

“This xx amount every month,” And make it easy.

Step 5: Easy Repayment

You must offer easy repayments via: Wallets. Cards. Bank auto-debit.

The simpler the repayment is, the safer the business becomes.

Step 6: Real-Time Update

Notifications are a must in today’s lives, especially when it comes to reminders for loans and installments. Also, payment reminders and transparency build trust every day.

Alright, Here is the Cost Breakdown for BNPL App Development

Here is where most founders get worried.

But don’t. We make it simple and honest:

The cost to develop a BNPL app like Affirm usually ranges between 20,000 USD to 150,000+ USD

Why such a wide range (if this question is in your mind): Because every BNPL product is different.

Look at this breakdown:

If you are a startup, you must:

- Start with MVP.

- Learn from real usage.

- Scale only what users love.

Where Does This Budget Actually Go

These four things mostly shape your cost:

1) Banking and payment regulations

Fintech cannot take shortcuts, and yes, compliance protects your future.

2) Security

Hackers love financial apps, so you must stay ahead of them.

3) Credit risk engine

This improves profit and reduces defaults. A strong one takes time to build.

4) Design and user trust

Fintech UI must feel safe. It should be less fancy. But quite confident and easy to use.

Do note: If any of these fail, the whole product collapses.

A BNPL Team You Actually Need

A real Affirm competitor needs more than just coders (oh! yes).

You need:

- Fintech Product Owner

- UI UX Designer who knows financial trust models

- Mobile Developer

- Backend Developer

- Security and QA

- Cloud and DevOps

- Compliance Advisor

- Fraud and risk model expert

When you work with SolGuruz, you get this full-stack dedicated team in one place. No hiring headache. No juggling freelancers.

Why Companies Trust SolGuruz for BNPL App Development

We speak two languages: Technology and Business Outcomes.

We help you with:

✔ Fintech compliance and risk strategy

✔ Modern scalable architecture

✔ Fast go to market with MVP approach

✔ Merchant onboarding strategy

✔ Secure and smooth user experience

✔ Post launch growth support

You bring the vision. We build the engine that makes it real.

Final Thoughts

BNPL apps are not a trend. They are a new habit. People expect flexible payments. Businesses depend on better conversions.

If you want to launch a BNPL app like Affirm, your timing is perfect.

And if you’re unsure where to begin, a fintech software development company can help you validate ideas, refine features, and execute the product the right way.

Let’s build something that users trust and love and that your business can scale safely.

FAQs

1. How long does it take to build a BNPL app like Affirm?

It usually takes around 3 to 7 months, depending on the scope of the app and the technology stack that you decide to use in the app development process.

2. Can BNPL apps work with both eCommerce stores and offline shops?

Of course. We support QR, POS and web integrations without any worries.

3. How do BNPL app owners make money?

Well, here is the secret that you must know. They earn money from merchant fees, interest, late fees and partnerships.

4. Do I need a lending license to launch?

Most countries require compliance. We guide you based on your region.

5. Can I start small and expand later?

Absolutely. That is the smartest strategy.

From Insight to Action

Insights define intent. Execution defines results. Understand how we deliver with structure, collaborate through partnerships, and how our guidebooks help leaders make better product decisions.

Build a BNPL App like Affirm

Talk to our fintech app experts and get a free cost and timeline estimate for your BNPL app.

Strict NDA

Trusted by Startups & Enterprises Worldwide

Flexible Engagement Models

1 Week Risk-Free Trial

Give us a call now!

+1 (724) 577-7737