Wealth Management Software for Founders & SMEs: Automate, Predict, Grow

The $5.4 trillion wealth management industry is rapidly digitizing in 2026, with AI-driven platforms attracting millennial investors. Modern wealth management software automates compliance, predicts market trends, and delivers personalized advisory at scale. This guide covers key features, development costs, AI integration, and launch strategies for a competitive edge.

What if you could grow your portfolio 2-3X faster than traditional investors, right from your phone?

Today, digital platforms serve 63% of millennial investors, yet many firms still rely on outdated tools.

Manual processes cost time and clients. Spreadsheet workflows slow decision-making. Lack of AI insights turns trades into guesswork, and compliance errors can trigger regulatory penalties.

With modern wealth management software, investors don’t just manage money; they unlock smarter decisions, faster growth, and a competitive edge that delivers the output every year.

In this blog, we explore how AI-powered wealth management software development is transforming the $5.4 trillion industry, covering key benefits, essential features, the development process, costs, and the latest trends driving smarter, faster investment decisions.

Table of Contents

Why Wealth Management Software is a Game-Changer?

Let me be straightforward: if you’re still dependent on manual spreadsheets to manage portfolios, compliance checks, and client advisory workflows, you’re losing efficiency, accuracy, and business scalability.

I’ve seen too many wealth management teams operate below their true potential simply because their tools can’t keep up.

According to Deloitte, Popular automated services currently use algorithms and machine learning to provide investment suggestions and management to clients. Robo-advisors managed around US$1 trillion by 2020, and around US$4.6 trillion by 2022.

Here’s what I’ve personally witnessed across digitized wealth management firms:

- 35% faster decision-making via automated portfolio insights

- 40% higher client retention due to personalized advisory models

- Centralized dashboard for transparency; e.g., clients track portfolio growth and tax impact anytime

It can be true to say that wealth management software has become an important part of the financial world. Now. Let’s explore the key benefits.

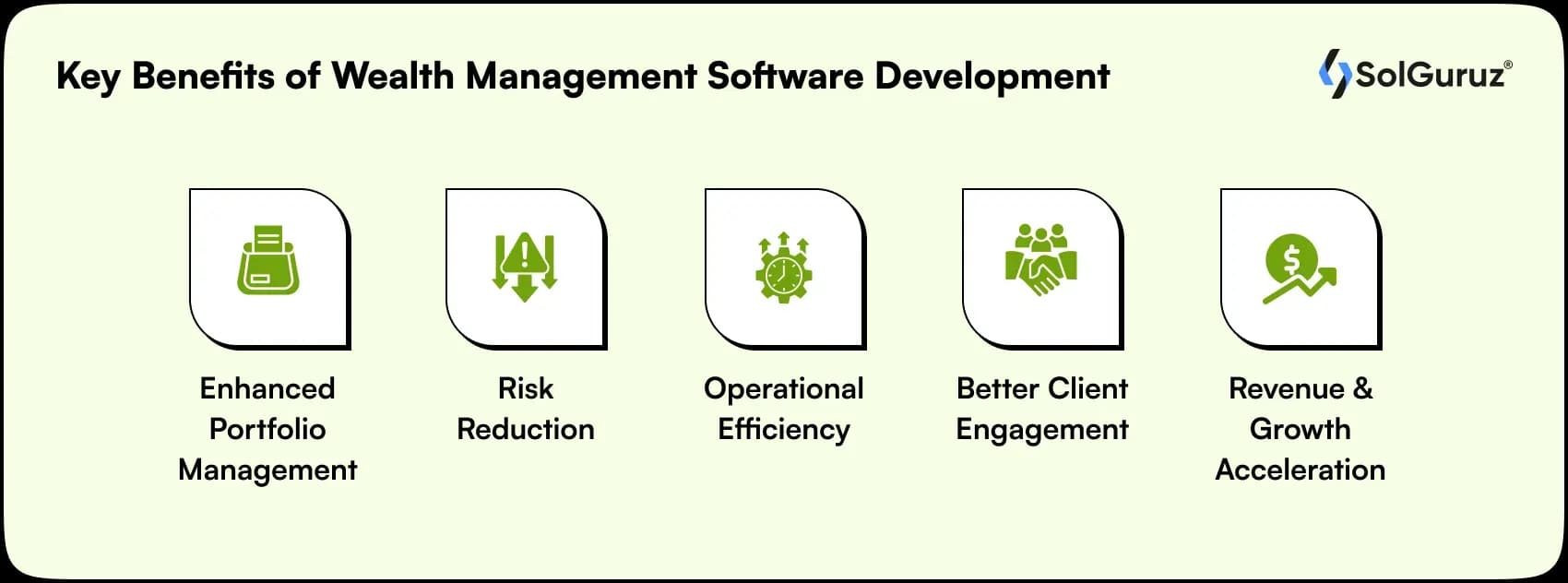

Key Benefits of Wealth Management Software Development

Do you really want to know why most of the companies and clients prefer wealth management software?

Here are the key benefits of wealth management software development influencing the decision-making process:

1. Enhanced Portfolio Management

Through the software, you can easily track multi-asset portfolios in real time, across ETFs, bonds, and other investments. AI insights identify the non-performing assets and emerging opportunities quickly.

2. Risk Reduction

As software is built with machine learning algorithms and learns from them, such algorithms constantly track market volatility, client risk profiles, and more. Predictive alerts help advisors mitigate losses before they occur.

3. Operational Efficiency

This software helps in managing the operations in a well-optimized manner. For example, an automated workflow replaces tasks such as the KYC process, documentation, approvals, and more. It eliminates the loads of paperwork and makes advisors free to shift their focus to business development.

4. Better Client Engagement

Better client engagement and trust can be gained by companies using wealth management software. It involves personalized dashboards, which ultimately show performance, keeping the client actively focused on financial planning.

5. Revenue & Growth Acceleration

Revenue and growth are boosted through smart automation, which helps in serving more clients without increasing team size. Firms using AI can obtain up to 20% higher returns per client portfolio.

Challenges and Solutions in Wealth Management Software Development

Developing wealth management software provides many opportunities for automation and smarter advisory, but it also requires addressing strategic and technical barriers early.

Below are some of the challenges and solutions mentioned as follows:

| Challenge | Description | Solution |

| Regulatory Compliance | Frequent changes in regulations make compliance tricky | Use automated compliance engines and dynamic audit trails |

| Data Security | Sensitive client data is at risk of breaches. | Apply encryption, MFA, role-based access, and blockchain audits |

| System Integration | Legacy systems may conflict with new AI tools | Use API-first design and unified data standards |

| User Adoption | Clients and staff may resist new tech | Offer intuitive UX, onboarding, and tutorials. |

| Scalability & Performance | Growing users can slow down the system | Implement cloud-native architecture with microservices and autoscaling. |

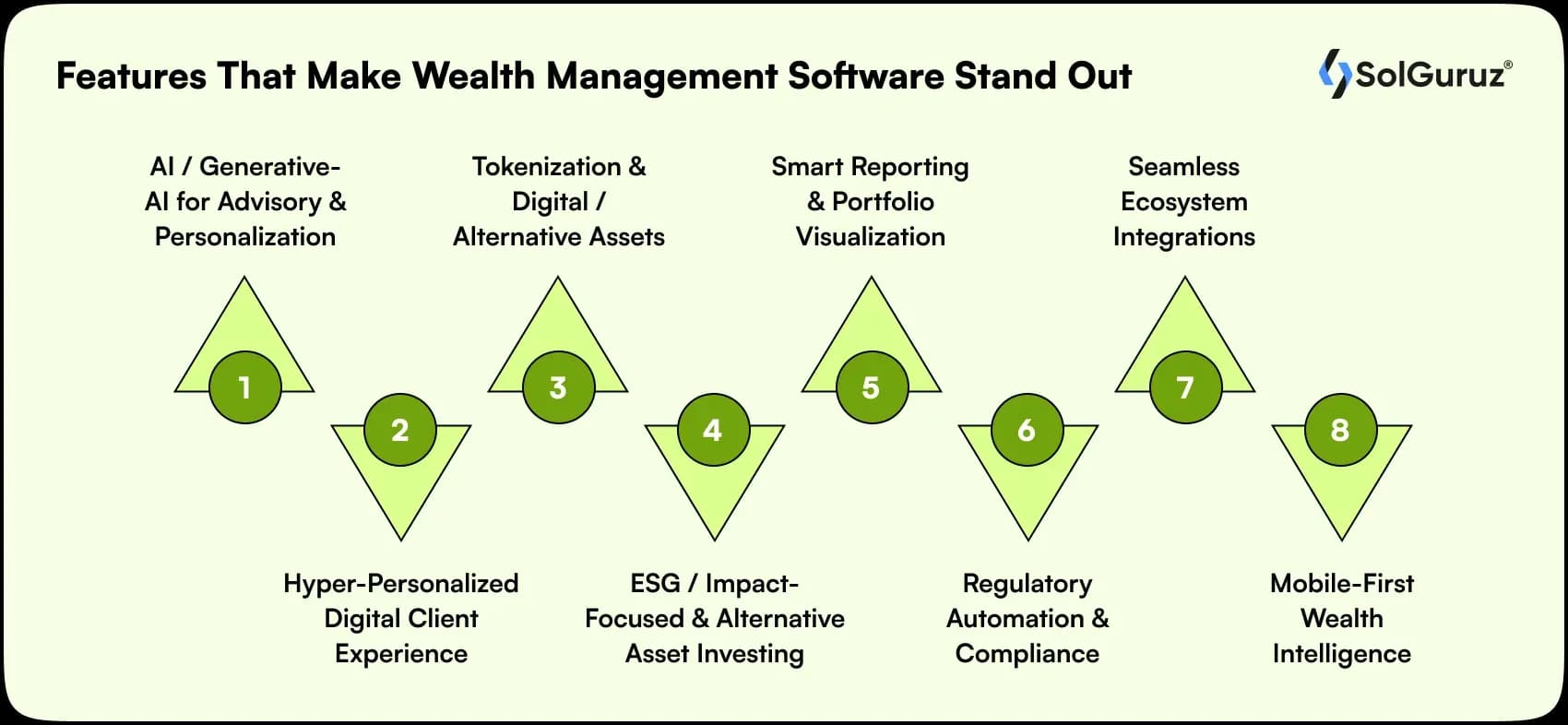

Features That Make Wealth Management Software Stand Out

Every software has a specific set of features that makes the difference from basic to advanced.

Time to see the key features that are important in wealth management software:

1. AI / Generative-AI for Advisory & Personalization

AI is changing wealth management overall by automating manual tasks and reducing paperwork, and assisting advisors with predictive analytics. Generative-AI and virtual wealth assistants now analyze portfolios, market signals, and client goals to recommend personal investment actions.

2. Hyper-Personalized Digital Client Experience

The platform now aims to deliver a customized dashboard, quick balancing options, and roadmaps for every investor profile. This level of customization enhances satisfaction, trust in the long term.

3. Tokenization & Digital / Alternative Assets

Tokenization is not new now, in fact, most wealth-based platforms are integrating tokenization of real-world assets like private equity, real estate, alongside crypto holdings. With tokenization, it enhances liquidity and allows for fractional investing, making assets more accessible to a wider client base.

4. ESG / Impact-Focused & Alternative Asset Investing

The demand for ESG-backed portfolios continues to grow on a major scale. Most of the modern platforms are focusing on evaluating social, environmental, and governance factors while providing access to private markets and other assets. This supports socially focused investing while expanding opportunities for long-term growth.

5. Smart Reporting & Portfolio Visualization

Dynamic reports are more effective and what clients want when they invest, as they prefer to know risk and threat factors, tax impact, and retirement forecasting in real time. Robust dashboards reduce manual financial modelling and enable clients to track progress.

6. Regulatory Automation & Compliance

To maintain speed with the changing regulations, the automated compliance engine tracks every transaction and communication for the SEC, SEBI, FINRA, and other frameworks. Real-time rule updates reduce operational burden and eliminate the need for manual tracking.

7. Seamless Ecosystem Integrations

With the rapid shift of technologies, new AI-driven systems can be easily integrated with banks, brokers and market data providers to reduce the workflow chaos. Autonomous synchronizations assist in eliminating human errors.

8. Mobile-First Wealth Intelligence

Clients and advisors expect complete portfolio control on smartphones, as well as on web or desktop interfaces. Mobile platforms now support alerts, performance tracking, and balancing everything. Faster engagement and response from users is possible via mobile access.

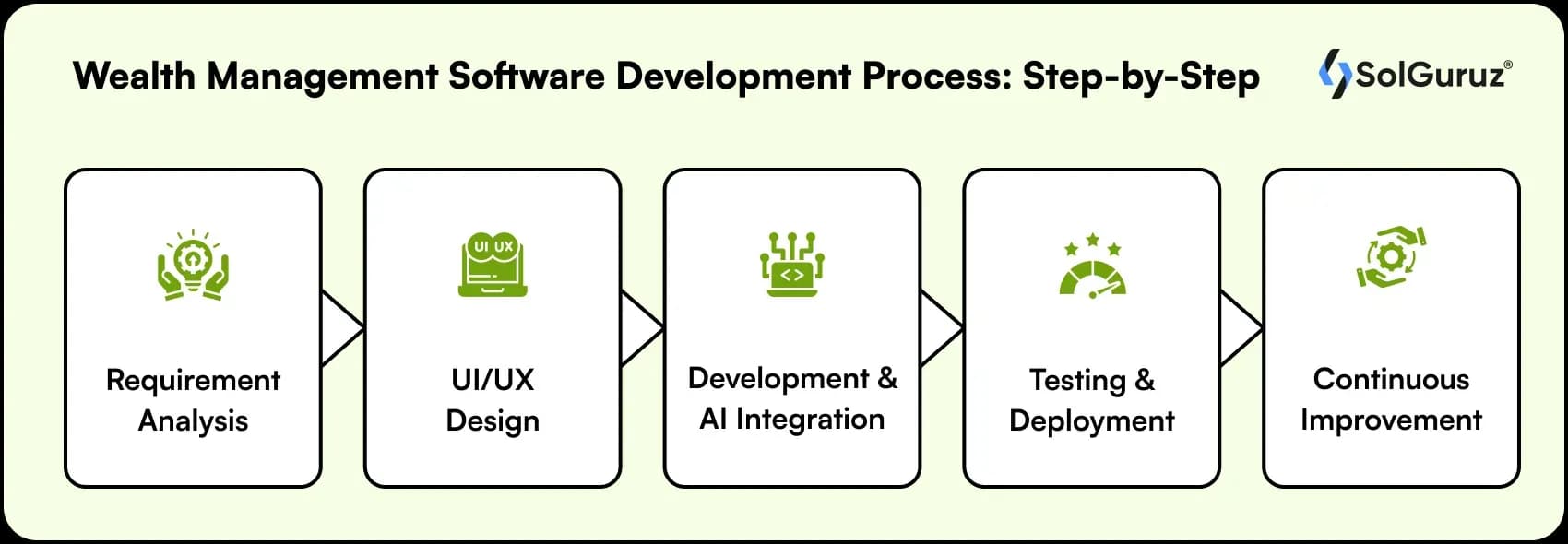

Wealth Management Software Development Process: Step-by-Step

A future-ready wealth management platform with a well-structured development cycle is important for you must know.

Here is the process to consider:

1. Requirement Analysis

We start by explaining why the app is needed to build goals, problem statements, and advisor workflows.

Conduct competition analysis:

- Helps in identifying important and differentiating features.

- Clear documentation ensures the platform aligns with both market demands and regulatory compliance.

2. UI/UX Design

Focus on:

- Stronger and user-friendly interface design

- Easy navigation with clear user flows

- Wireframes and prototypes for early usability testing

3. Development & AI Integration

Essential modules, such as reporting, KYC, and portfolio tracking, are developed. AI and ML models are integrated to enable risk profiling, personalized insights, and forecasting for investment.

4. Testing & Deployment

Testing is done at different layers, such as security functionality and performance, ensuring higher reliability. Real-world financial scenarios are simulated to validate accuracy and regulatory compliance.

5. Continuous Improvement

- Important to follow regular updates when focusing on software development.

- Ongoing monitoring ensures the platform is integrated properly with user behaviour patterns.

Top Tech Trends in Wealth Management

With the rapid shift of the financial landscape, evolving quickly, technology has become a driving force behind smart decisions, improving client experience and strategic approaches for wealth management firms.

Below are the Tech Trends of Wealth Management Software shaping the industry in 2026 and beyond:

1. Predictive Analytics & Machine Learning

Predictive analytics and machine learning allow wealth managers to determine market movements and client behaviour prior to their happening.

Such technologies examine:

- Historical data, trends

- Risk factors

By doing so, they make a strategic approach wisely, and this helps advisors make smarter decisions.

2. Robo-Advisors

With robo-advisors, clients get affordable and automated investment advice to clients making wealth management accessible.

They provide algorithm-driven portfolio suggestions and balancing without human involvement. This trend enhances efficiency while providing consistent and the best investment strategies.

3. Blockchain & Smart Contracts

What do they do?

- Improve security,

- Transparency, to a higher level of trust in financial transactions.

4. Natural Language Processing (NLP)

Virtual assistants and AI chatbots use natural language to respond quickly to client queries.

It helps in

- Portfolio updates and advice,

- Reduces in minimizing the workload on human resources.

5. Data Visualization & Interactive Dashboards

With ease of data visualization, they make it easier for clients to check out their portfolios with charts, risk insights and performance metrics.

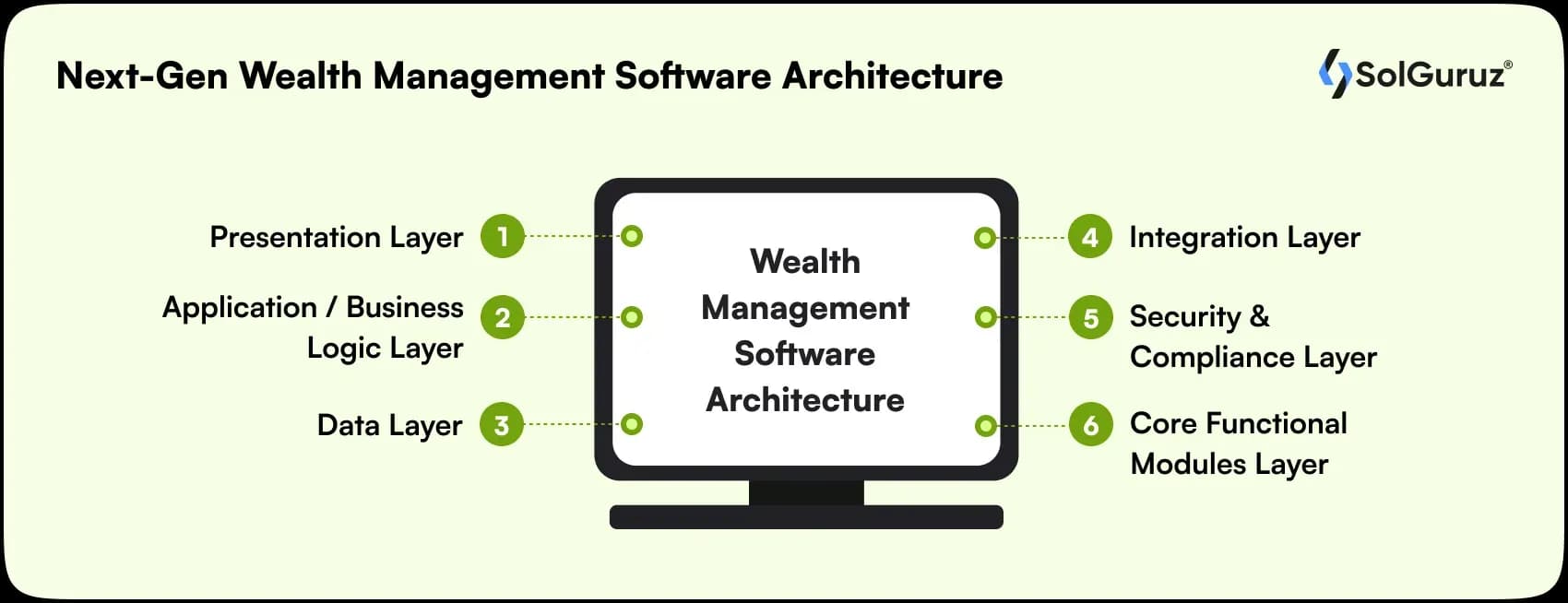

Next-Gen Wealth Management Software Architecture

Creating a well-structured wealth management software platform requires a rigid and layered architecture to ensure security and scalability. The various layers and elements create the backbone of modern wealth management software.

Let’s see below the different layers:

1. Presentation Layer (Frontend)

This form of layer provides web and mobile interfaces for clients and advisors, providing interactive dashboards and tracking tools.

The client portal ensures secure access to performance reports, messages, and portfolio insights. This layer focuses on delivering a smooth, engaging user experience.

2. Application / Business Logic Layer (Backend)

In software development, the backend plays an important role. It handles all business logic involving user authentication, investment rules and transactions, and more.

Different technologies such as Django, Python, .NET, and Java are mostly used for functionality.

3. Data Layer (Databases & Governance)

In this layer, it specifically stores the client data, such as profile, transactions, and other portfolio information, using NoSQL, SQL, PostgreSQL, and more.

4. Integration Layer (APIs & Middleware)

CRM and accounting software are integrated internally via APIs or middleware with external providers, along with custodians. Open architecture enables smooth integration with third-party fintech tools and AI services.

5. Security & Compliance Layer

With increased risk of data theft and cyber attacks, it has become essential to have a high-end and strong security system to protect from unauthorized persons. Security measures such as encryption, role-based access control can be adopted.

6. Core Functional Modules Layer

In this layer:

- It aims at critical wealth management features, involving portfolio tracking, asset allocation, and more.

- Ultimately supports financial planning, risk analysis, and automated reports

With the right Fintech Software Development Company, this architecture becomes a strategic advantage.

Cost of Wealth Management Software Development

The cost of developing wealth management software depends on the app, its architecture complexity, features, and more.

Below is the cost breakdown to help estimate investment based on your business objectives:

1. Basic Version: $20,000 to $45,000

- Most suitable for startups and early-stage wealth management firms

- It also includes key features such as:

✔ Portfolio tracking

✔ Client profiles & onboarding

✔ Transaction history

✔ Performance & reporting dashboards - Assists in establishing an initial digital presence at a low cost

2. Intermediate Version: $50,000 to $80,000

- Good for growing wealth management companies

- Adds powerful AI-driven capabilities, including:

✔ Predictive analytics & risk analysis

✔ Personalized investment recommendations

✔ Smart forecasting engines - Allows deeper client engagement and data-driven decision-making

3. Advanced Version: $90,000+ $150,000

- Developed for enterprises, private banks, and global advisory platforms

- Involves full-scale, next-gen automation with:

✔ Multi-asset wealth management

✔ Real-time automation & robo-advisory models

✔ Smart compliance & regulatory reporting

✔ End-to-end AI investment decision support - Delivers unmatched scalability and future-ready digital advisory

Investing early in AI-powered wealth management software increases ROI by improving client retention, operational efficiency, and long-term competitive advantage. In 2026 and beyond, companies that adopt AI now will be in the top position in the market.

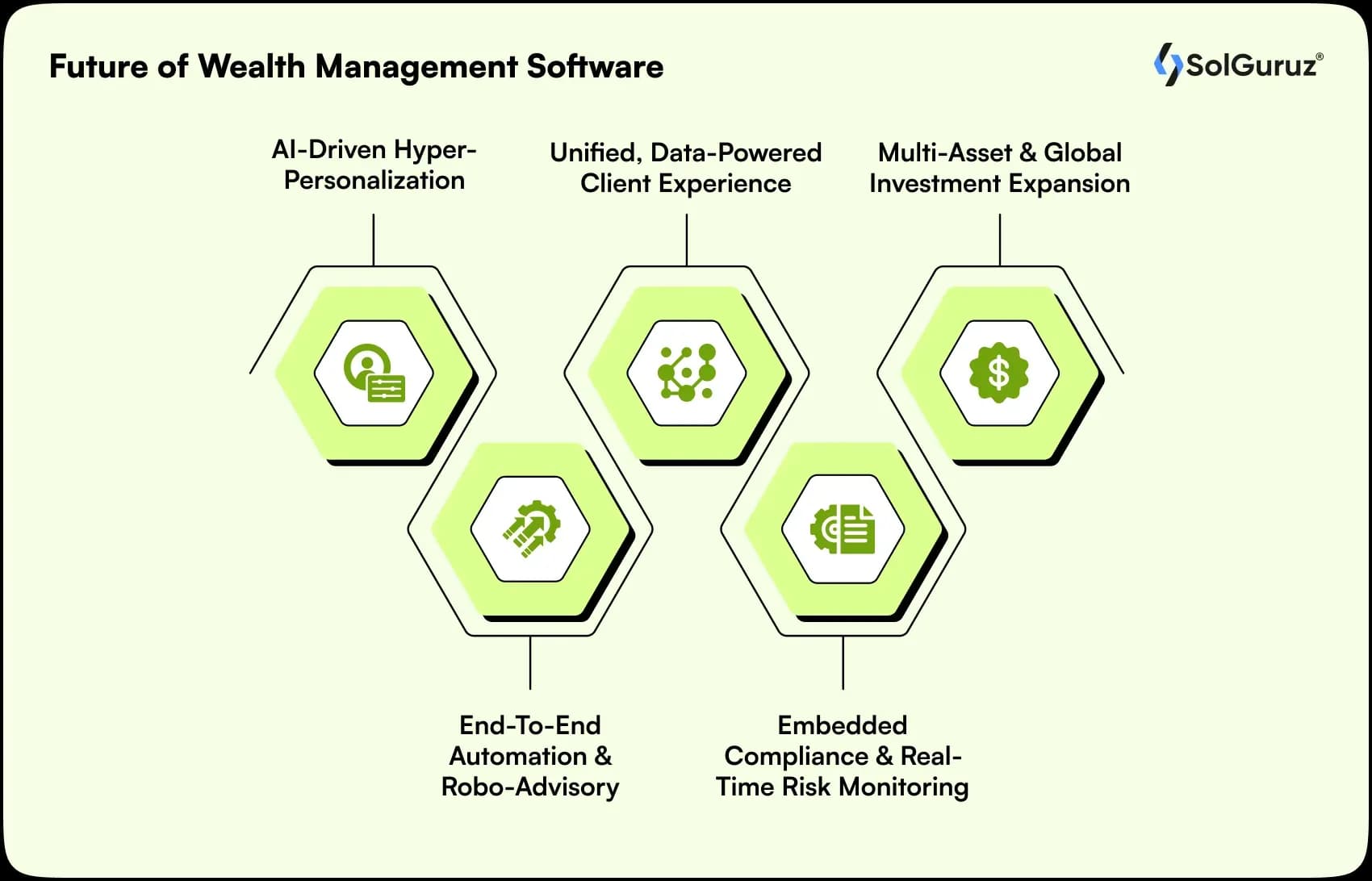

Future of Wealth Management Software

Time is changing with AI at a rapid pace, and with AI, automation, and data-driven insights, wealth management is not only about handling the money of clients, but it’s about making effective decisions, faster and smarter, that boost growth.

Below are some other factors that will transform the software at the core:

1. AI-Driven Hyper-Personalization

Through AI, it will create investment plans that match per investor’s personal goals, examine risk levels, and behaviour. Further, it explores the market trends in real time and adjusts recommendations automatically, ensuring every investor gets personalized advice instead of random strategies.

2. End-to-End Automation & Robo-Advisory

All the time-consuming tasks, such as compliance checks, onboarding, and reporting to be handled by AI. This eliminates the manual effort and operational cost while enabling advisors to focus more on client relations and building strategy.

3. Unified, Data-Powered Client Experience

Yes, you will be able to see and manage all clients’ credentials, data, liabilities, assets, events, market exposure and more in unified single dashboards. It allows investors and clients to track financial health right on the spot.

4. Embedded Compliance & Real-Time Risk Monitoring

This software will have the ability to track anonymous access from unknown identities, fag risky transactions, and enforce regulatory standards (SEBI, SEC, FINRA) and more.

5. Multi-Asset & Global Investment Expansion

Future platforms will allow for investment across traditional and alternative assets (equities, bonds, crypto, real estate, ETFs, etc.) with real-time asset reconciliation and cross-border market support.

Your Next Move: Turning Software Into Competitive Advantage

Are you prepared to compete in a market where technology now defines leadership?

The wealth management industry’s transformation is already rolling out in the marketplace. Firms that treat software as a strategic asset are gaining market share, while those that stick to outdated systems struggle to get trusted clients.

Don’t wait for modernization; it gives competitors a benefit to stay ahead. Adapting to modern wealth management software has become essential, and it is not optional, but mandatory.

Ready to build a platform that gives you a competitive edge?

For a professional app development partner who understands both technology and wealth management, choose SolGuruz in your journey of transforming your goal into powerful, scalable software solutions. The time to act is now. Lead the transformation, don’t follow it.

FAQs

1. What exactly is wealth management software, and how is it different from traditional financial tools?

A wealth management software is a combination of risk analysis, portfolio tracking, and AI-based recommendations, all in a single unified platform. Comparing it with traditional spreadsheets, it focuses on automation of workflows and integration of data from multiple sources and provides real-time insights. This makes advisory services efficient and more accurate.

2. Can small firms or startups afford to build or adopt such software?

Yes, there are basic versions of wealth management platforms designed for smaller firms or startups. These include portfolio tracking, client onboarding, and reporting features at a lower cost, allowing firms to start digital operations without a larger investment.

3. Will AI‑powered features replace human financial advisors completely?

No, it is not mandatory. No doubt AI in wealth management helps in the automation of your workflow, and can predict the market situation and provide personalized suggestions. But still, the intervention of human advisors is crucial for informed decisions, emotional guidance and complex planning setup.

4. How does the software ensure compliance and data security in a regulated environment?

Modern wealth management platforms are built with the support of compliance engines that track transactions, audit trails, and regulatory reporting standards. They also use stronger encryption, role-based access, and ensure data safety so that client information is stored securely.

5. What kind of return on investment (ROI) can firms expect after?

There is a huge return on investment that can be extracted from the software; companies can see a faster decision-making process, retention of clients for longer terms, and more effective operations. Additionally, with automation and AI-driven capabilities, it can help in serving more clients without staff enhancement.

From Insight to Action

Insights define intent. Execution defines results. Understand how we deliver with structure, collaborate through partnerships, and how our guidebooks help leaders make better product decisions.

Upgrade Your Wealth Strategy

Gain smarter insights and better efficiency with Wealth Management Software.

Strict NDA

Trusted by Startups & Enterprises Worldwide

Flexible Engagement Models

1 Week Risk-Free Trial

Give us a call now!

+1 (724) 577-7737