How to Build a Money Transfer and Convert App Like Revolut?

From a simple idea to a global fintech revolution, explore how you can build an app like Revolut. Know the business model, cost structure, and development roadmap to launch your own fintech app and money transfer platform.

Those days are gone when you needed cash for every transaction you wanted to make. Now, every minute or second, millions of financial transactions happen globally online.

Yet, many users still struggle with slow speed transfers, hidden fees, and higher charges, including a complex banking process.

This has become more convenient now due to the introduction of the Revolut app that completely changed digital banking by offering seamless money transfers, currency conversion, cryptocurrency trading, and more. Everything can be done with a single app.

With the growing global user base, the demand for similar digital banking apps continues to rise. In this blog, we’ll explore how to build a fintech app like Revolut, from features and technology to cost and development stages, with the help of a Fintech Development Company.

Table of Contents

Understanding Revolut’s Success: What Makes It Stand Out?

Many clients come to us saying, “We need help with our idea to build an app like Revolut, but better for our users, and that can solve their pain points.”

Before diving into development, it’s critically important to know why Revolut has become a fintech giant in the 21st century.

The main reason? It directly connects several financial services into one smooth user interface, which makes users’ journey easier when making a money transfer from anywhere.

Users get fast money transfers, real-time currency exchange at interbank rates, EMI support, crypto trading, and even stock investment, all just in one app.

What really sets it apart is the user-centric approach.

Ye, no hidden fees, full transparency, and simplicity that the old method of banks struggles to deliver to their users.

When you create an app like Revolut with the help of a Fintech App Development Company, you’re not just building software, but you’re building up a financial community that motivates users to take full control of their money, where it is going, to whom, and what the status of transactions is.

Development Process for a Fintech App Like Revolut

Turning a fintech idea into a trusted app isn’t just about coding, but providing users with a product they can actually rely on for everyday purposes. Beneath we have discussed the development process:

Phase 1: Market Research & Planning

When you are focusing on creating a fintech app, make sure to have notes, a roadmap of research, and strategies that can be used.

Phase 2: Design & Prototyping

A critical stage in which the main focus is on user-centric design and testing prototypes at the early stages. You need to aim for proper clarity, minimalistic widgets, and smooth navigation to provide a better experience.

Phase 3: Backend Development

Backend development is the core base of your app development. Develop a well-secured, scalable backend with strong architecture. Make sure to integrate payment gateways and structure the data to make high-volume transactions easier to manage.

Phase 4: Frontend Development

Create cross-platform mobile apps (iOS & Android) or use cross-platform tools like Flutter or React Native. Focus on integrating it with real-time updates and offline accessibility.

Phase 5: Security Implementation

For security, end-to-end encryption needs to be implemented, secure storage (cloud, SAAS), and regular audits need to be done. Protect the key credentials of the users from day one.

Phase 6: Testing & Quality Assurance

Testing and QA are to be done so that errors are pre-identified before the final deployment process of the app. Simulate high usage to ensure smooth operations under pressure.

Phase 7: Launch & Post-Launch Support

In this phase, you can launch with a small niche group of your audience as a smaller test part, you can collect feedback, fix the bugs and expand globally. After this, for post-launch support, provide regular updates to the users as problems arise.

Key Note: Going with the key steps ensures your fintech app is secure, user-centric, and scalable from the start.

Business Model of Revolut Like App

Business revenue models are necessary to be chosen based on the target audience’s needs and market criteria. Below are the key revenue streams you can choose for your fintech app:

| Revenue Stream | How It Works | Benefit / Purpose |

| Subscription Tiers | Free basic tier + premium tiers with enhanced features such as priority support, higher limits, and more. | Income generative and user loyalty show app credibility |

| Transaction Fees | Small fees on currency exchanges, crypto transactions | Provides good income revenue without forcing users to subscribe |

| Interchange & Merchant Partnerships | Earn fees from card transactions and cashback partnerships | Passive income while adding value to users |

| Interest & Lending | Personal loans, overdraft facilities, and interest on deposits are to occur. | More revenue and strengthens user trust |

As recorded by BGC (Boston Consulting Group), “$13 trillion in global banking and insurance revenues are still rolling out in the Fintech marketplace and are going to disrupt the base at a massive level. Hence, don’t wait; just enter as the market tends to be more aggressive.

Tech Stack in Fintech App Development

In the mobile app development process, technology is used with detailed research and checking out competitors’ architecture to see what they are using. Here are some examples of such technologies that are most needed by developers:

1. Frontend Technologies

For native iOS development, Swift can be used. For Android, Kotlin has become the most preferred choice of language. Further, coming to cross-platform frameworks, going for embedding with React Native or Flutter enables a single codebase, minimizing costs and multiple platforms simultaneously.

2 . Backend Technologies

Coming to the backend, Node.js is good at handling concurrent connections, making it ideal for real-time financial operations. Python and Java can be used for better functionality.

3. Database Solutions

PostgreSQL and MongoDB can be used for complex transactions and storage of different data types all at once.

4. Cloud Infrastructure

Different types of cloud platforms can be used for storing data, such as Google Cloud, AWS, or Microsoft Azure provide scalable infrastructure with built-in security features.

5. Security Tools

Using security tools and implementing SSL/TLS certificates for encrypted communication is also crucial for the safety of data of users. You can also choose to opt for OAuth 2.0 for properly secured authentication.

A dedicated development team is capable enough to use these key tech stacks as per your requirements and can alter the options accordingly.

Here is a detailed guide for Founders, CTOs & SMEs on how you build your dedicated development team.

Core Features to Build an App Like Revolut

Before building an app, it is crucial to know what features to include. Let’s explore some of the core features to be included in a fintech app:

| Feature Category | Key Features | Purpose / Benefit |

| Banking Features | Multi-currency accounts & instant P2P transfers | Send, receive, and exchange money across different currencies quickly. |

| Advanced Financial Tools | Digital debit cards | Notification alerts and regular updates on the App Store or Google Play |

| Security & Compliance | Biometric & two-factor authentication | Protect accounts and sensitive transactions |

| Customer Support & Engagement | In-app chat & ticketing | 24/7 support solves the problems faced by users right on the spot. |

| Rewards & Loyalty Programs | Cashback on card usage | Motivates users to spend more; they also receive rewards and loyalty points for their purchases. |

Cost of Fintech App Development Like Revolut

The cost is based on features, AI complexity, and speed. Below is the easy cost structure to follow for building an MVP into a feature-packed app:

| Component | Estimated Cost (USD) | Notes |

| UI/UX Design | $5,000 – $7,000 | It focuses on including testing of wireframes, prototypes, and visual elements design |

| Frontend Development | $10,000 – $35,000 | Cross-platform app development (iOS and Android) |

| Backend Development | $20,000 – $55,000 | APIs, databases, and payment gateway integration |

| Testing & QA | $10,000 – $15,000 | Functional testing, performance and KPI benchmarks, and security testing are done |

| Security Implementation | $5,000 – $15,000 | For the security implementation, focus on 2 factor authentication, prevention from fraudulent activities and more |

| Compliance & Legal | $7,000 – $12,000 | KYC, GDPR and regulatory adherence to all compliance. |

Key Takeaways: Hire App Developers who can complete your goal of a fintech app with industry-focused criteria as per your budget requirements.

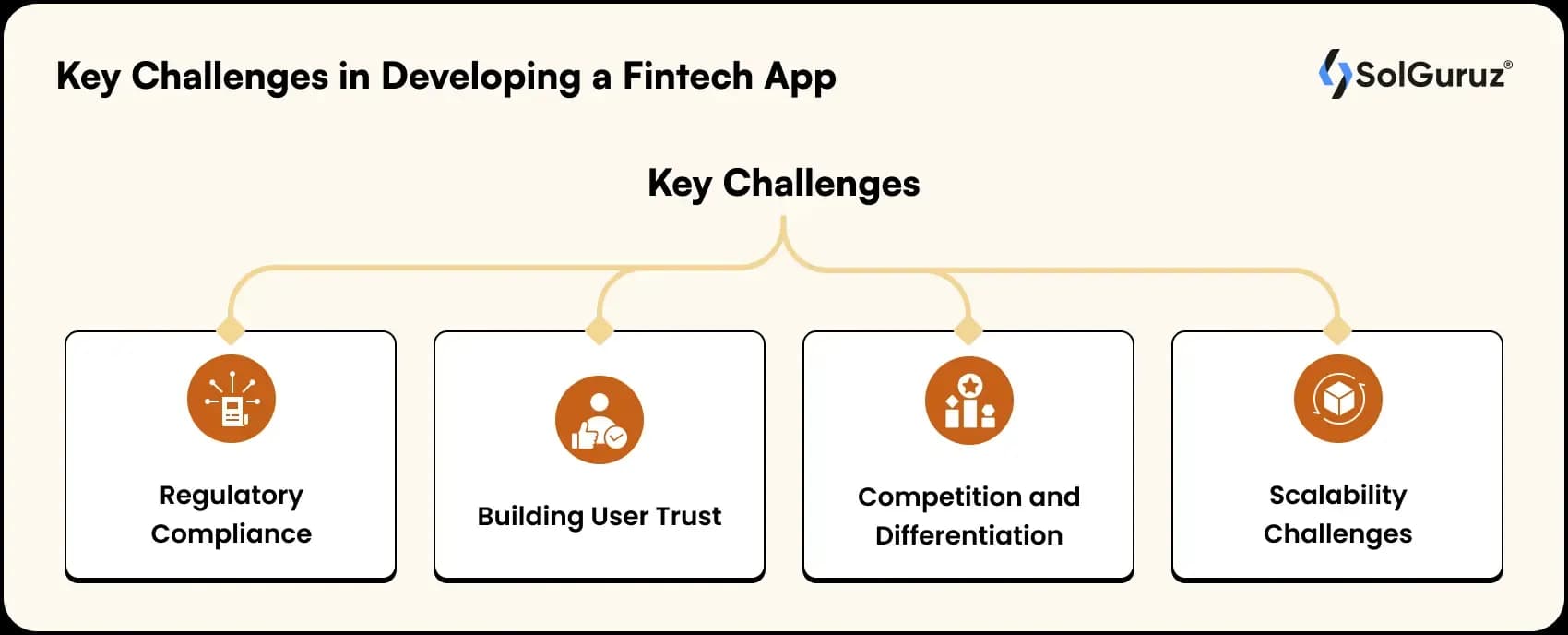

Key Challenges in Developing a Fintech App

Building a fintech application is not an easy process, and it often comes up with lots of issues. Below are some of the obstacles that affect your fintech app development process:

1. Regulatory Compliance

Going through financial regulations around several jurisdictions leads to a lot of headaches, even if you have experienced developers. Each region has its own set of requirements and legislative processes for money transmission licenses, data protection, and you need to make sure to hire legal experts of that particular country.

2. Building User Trust

Another big challenge is developing trust between customers. With the rise of theft of users’ data via different online practices, creating trust between the audience and your app can be a bit of a complicated process.

3. Competition and Differentiation

The fintech world is overcrowded. Nowadays, you can see numerous apps rolling out in the market. The competition level is booming and making a different, unique featured product is again a key challenge.

4 . Scalability Challenges

Your app should be capable of handling increasing transaction volumes without a performance mismatch in quality. Ensure that scalability is the key focus from the day you start creating an app.

Thus, by properly solving these key challenges and planning with regular updates, you can build a fintech platform that’s secure and reliable to use.

Why Partner with a Fintech App Development Company?

Many companies still are not aware of why they should use fintech app development companies instead; they do it by hiring gig developers randomly, which is quite a bad decision. Here are critical points to be noted down that show why you should hire one:

1. Expertise & Domain Knowledge

Hiring fintech app development companies that have experience in the same domain and are capable enough to navigate regulatory compliance and fintech-focused challenges more conveniently.

2. Dedicated Development Teams

Such companies have a dedicated development team with comprehensive skills that can be utilized to accelerate the entire development cycle, maintaining higher code quality.

3. Problem-Solving Experience

Yes, the fintech app development partners have expertise in solving complex financial-related issues or can detect fraudulent events if they occur in any way.

4. Post-Launch Support

Make sure that your app evolves with user needs effectively and that technology trends are being followed.

Explore SolGuruz Case Study

Check out our case study we did on the fintech BNPL app development: Flexipe.

The main goal of the app was to make BNPL feasible to the users with the concept of shop now and pay later.

This case study demonstrates our end-to-end development process, from idea validation to deployment, showing how we turn complex fintech concepts into improved digital experiences. It also highlights the impact of our solutions on user engagement and business growth, reflecting SolGuruz’s expertise in mobile app innovation.

Our dedicated team is focused on delivering robust mobile apps with user user-centric approach and data security as the primary factor.

Starting Your Fintech App Development Journey

The fintech world is booming, and competitors are winning the race due to their innovative mindset. Creating an app like Revolut is challenging nowadays, but it is achievable with proper planning, the right team, and the right choice of a mobile app development partner.

The question isn’t whether you should enter the fintech world, but how fast you can catch up to the gap and user pain points.

At SolGuruz, with our dedicated development team, we have turned your fintech visions into market-leading realities with AI-powered solutions.

Our track record includes developing sophisticated fintech applications that process millions of transactions securely and smoothly.

Choosing SolGuruz will ease your process of creating a Fintech app and will provide you with additional mobile app development services you can think of.

FAQs

1. How much does it cost to build a fintech app like Revolut?

A basic MVP could cost you around $10,000–$30,000, while a feature-packed app could cost you from $30,000–$1,50,000+ and more.

2. How long does it take to develop a Revolut-like app?

Every company has a different timeline based on a different time zone. Fintech apps take 3–6 months for an MVP and 7–12 months for a full-featured platform, including designing, the process of development, testing, and complete final setup.

3. What are the key features needed in a fintech app?

There are several key features to focus on, such as stock and trading features, digital cards, budget tracking, savings automation, and a lot more.

4. Which tech stack is best for a fintech app?

Various technologies are used, for example, Swift/Kotlin for native apps, React Native/Flutter for cross-platform, Node.js, Python, or Java for backend, and so on.

5. Why should I hire a fintech app development company instead of random gig developers?

Yes, it is necessary to hire a fintech app development company because they have years of expertise in the domain. Their skills and knowledge can be helpful for your app development as they can solve complex problems right away.

From Insight to Action

Insights define intent. Execution defines results. Understand how we deliver with structure, collaborate through partnerships, and how our guidebooks help leaders make better product decisions.

Build Your Fintech Future

Partner with SolGuruz expert developers and Get your custom roadmap today.

Strict NDA

Trusted by Startups & Enterprises Worldwide

Flexible Engagement Models

1 Week Risk-Free Trial

Give us a call now!

+1 (724) 577-7737