A Beginner’s Guide to Fintech Services: What is Fintech App Development?

We offer top-notch Fintech app development services if you want to follow the change and trend as a Fintech service provider.

Fintech services, encompassing financial technology, have revolutionized traditional banking practices by enhancing convenience, affordability, security, and accessibility through digital solutions. Advancements in disruptive technologies like artificial intelligence, blockchain, and alternative lending are reshaping financial services, allowing firms to innovate, streamline processes, and improve customer experience. And therefore, there is enormous scope in Fintech app development.

If you are in the Fintech services business, take note that the global fintech industry looks set to expand at a compound annual growth rate (CAGR) approaching 20% within the next few years, reaching an estimated market valuation of approximately USD$305 billion by the year 2025, according to recent projections reported by GlobeNewswire.

This remarkable projection underlines the increasing adoption of disruptive technologies, changing consumer preferences, and shifting paradigms in the financial sector. As leading players continue to innovate and adapt to dynamic market conditions, the future seems bright for those who embrace digital transformation in financial services. Now is the time to collaborate with a fintech app development company and grow in the business of fintech services.

Table of Contents

What is Fintech? What is Included in Fintech Services?

Fintech, short for Financial Technology, refers to the intersection of the financial services industry and modern technology. It involves leveraging digital tools, software applications, mobile devices, and web interfaces to deliver financial products and services that brick-and-mortar banks or other financial institutions traditionally offer.

Fintech companies aim to provide more convenient, accessible and cost-effective ways for people and businesses to manage their money, conduct financial transactions, and invest.

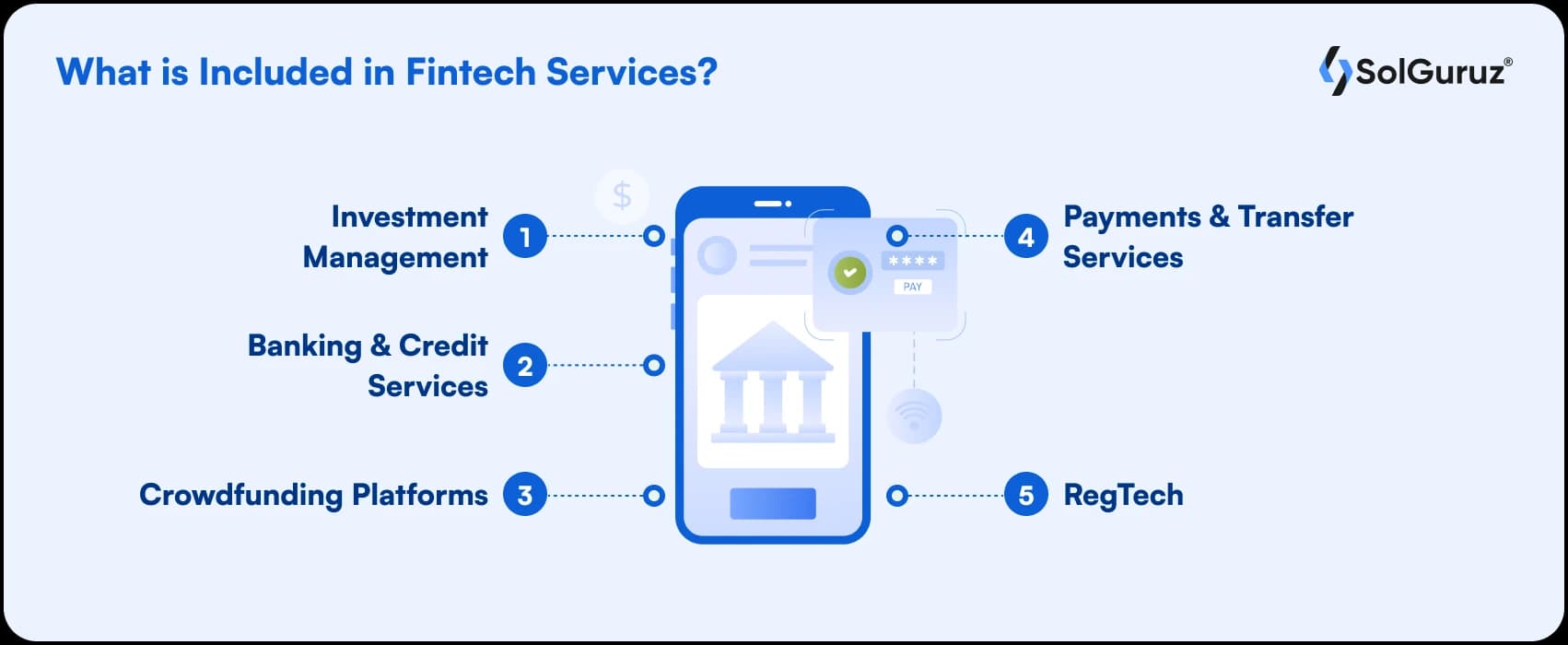

Fintech services typically fall into several categories, including:

-

Investment Management

Robo-advisory services, algorithmic trading, social trading platforms, and wealth management solutions using automation and machine learning. Notable examples include Wealthfront, E-Trade, etoro, and Schwab Intelligent Portfolios.

-

Banking & Credit Services

Online-only bank accounts, loans, mortgages, asset management, insurance, and investment services are provided through digital channels. Firms such as Marcus by Goldman Sachs, Robinhood, Betterment, SoFi, and N26 cater to diverse user segments.

-

Crowdfunding Platforms

Enables startups, artists, nonprofits, and others to raise funds from multiple contributors via internet-based campaigns. Websites like Kickstarter, Indiegogo, GoFundMe, Seedrs, and Patreon serve various purposes.

-

Payments & Transfer Services

Digital payment methods, P2P lending, international remittances, and virtual wallets allow users to send and receive funds seamlessly across borders. Examples include Venmo, Zelle, PayPal, Revolut, Stripe, and TransferWise.

-

RegTech

Leveraging Generative AI, ML, and Cloud Computing, RegTech helps financial institutions meet regulations, perform compliance checks, fight fraud, and enhance cybersecurity. Examples include Arachnys, AlgoSec, Axiomatic Technologies, and Fintelix.

Why are Fintech Services Popular?

Fintech services have become increasingly popular for several reasons, including convenience, accessibility, affordability, speed, security, and customization. These benefits address many pain points experienced by customers when dealing with traditional financial institutions.

-

Convenience

Fintech services can be accessed from anywhere, anytime, on any device. With no physical branches or limited operating hours, users enjoy greater flexibility in managing their finances without travelling to a branch location. Mobile apps and online portals enable easy account management, transaction processing, and information retrieval.

-

Accessibility

Unlike traditional banks, which often require high minimum balances or specific income levels, fintech services are open to all customers regardless of their financial status. The democratizing effect makes these services attractive to underserved populations, SMEs, and remote workers, allowing them to participate in the formal economy.

-

Affordability

Lower operational costs for fintech providers translate to lower prices for customers. Many fintech offerings offer minimal or zero fees for essential services like transfers, payments, and account maintenance. Additionally, fintech services offer better exchange rates than traditional banks or brokers, making cross-border transactions less expensive.

-

Speed

Fintech services process transactions much faster than traditional institutions. Instant payments, same-day settlements, and rapid loan approvals save time for customers who need quick access to funds. Rapid digitization has made it possible for fintech providers to execute transactions almost instantly while maintaining the required level of security.

-

Security

While security concerns remain prevalent among some potential users, fintech service providers prioritize robust measures to protect customer data and assets. Advanced encryption protocols, multi-factor authentication, biometric verification systems, and regular audits ensure secure interactions between customers and providers.

Fintech services have evolved rapidly over recent years, driven by advancements in cloud computing, artificial intelligence, blockchain technologies, and shifting consumer preferences towards digital experiences. As society continues to embrace innovation and move away from traditional approaches to financial management, we can expect further growth in adopting fintech solutions.

Additional Benefits of Fintech Services

Before we dive into why we should go for Fintech app development, here are some additional benefits.

The rise of fintech has brought numerous advantages for consumers beyond just saving money and time. Several benefits offered by these digital financial firms include:

-

Tailor-Made Advice through Artificial Intelligence

Thanks to AI and machine learning, many fintechs now present personalized suggestions and guidance regarding savings, expenses, and investments. Users receive intelligently crafted insights into their current financial status and make well-informed choices.

-

Improved Accessibility to Credit

Traditionally underserved individuals often struggle with accessing loans or mortgages. With advanced analytics methods like alternative data sourcing and AI modeling, fintechs evaluate creditworthiness without relying solely on credit scores. Hence, they facilitate increased borrowing opportunities for people previously excluded by conventional banking practices.

-

Boosting Financial Knowledge

Digital finance platforms frequently offer interactive tutorials, calculators, and other educational materials. Consumers gain practical skills in handling their finances effectively, leading to greater confidence when managing budgets, avoiding debt, and planning long-term savings strategies, including modern digital investment approaches such as Bitcoin savings strategies, which enable automated, recurring investments in Bitcoin to support disciplined wealth building and long-term portfolio diversification.

Fintechs’ utilization of modern technological capabilities enables them to offer these extra benefits that complement traditional advantages associated with ease of use, cost efficiency, and timeliness. This expanded scope empowers customers to enhance their fiscal lives and attain sustainable wealth growth.

The Rise of FinTech

Since the turn of the century, financial technology (FinTech) has undergone revolutionary changes due to the widespread adoption of digital tools and platforms across various industries. The rise of FinTech and open finance marks a significant shift towards decentralization, collaboration, and inclusivity in the global financial ecosystem.

FinTech investments have grown exponentially in recent years, reaching record levels in deal count and total funding volume. According to data from Accenture, global investments in FinTech ventures nearly doubled between 2017 and 2018, jumping from US$18.4 billion to US$36.4 billion during that period. Furthermore, FinTech investment rounds exceeded 3,000 globally in 2018 alone, signaling unprecedented interest from private equity investors and institutional funds.

The emergence of available finance, characterized by distributed ledger technology (DLT), smart contracts, and tokenization, represents another significant disruption within the broader FinTech space. Driven by the rise of cryptocurrencies such as Bitcoin, Ethereum, and others, available finance provides a framework for enabling peer-to-peer financial interactions without intermediaries.

Moreover, the advent of security tokens has opened doors to fractional ownership structures and non-custodial asset trading, allowing retail investors access to traditionally exclusive asset classes.

Open finance also extends to the domain of lending, where blockchain-based protocols enable P2P lending, crowdfunding, and microloans at lower fees and transaction times than traditional banks. Decentralized finance (DeFi) platforms, powered by open-source community efforts and automated governance models, represent yet another facet of open finance’s potential to shape the future of financial services.

While regulatory challenges persist, particularly in jurisdictions with strict laws governing digital currencies and financial activities, policymakers around the globe acknowledge the significance of harnessing FinTech and open finance innovation to drive economic growth, enhance financial inclusion, and foster competition.

Central banks like the Bank of England, the Monetary Authority of Singapore, and the Swiss National Bank actively explore issuing central bank digital currencies (CBDCs) to ensure resilience against systemic shocks and improve monetary policy transmission channels.

International organizations like the World Economic Forum and International Monetary Fund also recognize the importance of collaborating with stakeholders in shaping responsible policies for sustainable FinTech and open finance ecosystems.

Why is it the Right Time to Go for Fintech App Development?

Numerous reasons suggest that now is an ideal moment for businesses to consider developing a fintech app. First and foremost, the fintech industry continues to experience exponential growth as consumers increasingly rely on digital channels for financial transactions and management.

According to market research firm Statista, global revenues for fintech companies reached $98 billion in 2017, up from only $45 billion four years earlier. As demand for online financial services persists, there exists enormous potential for new fintech startups and existing ones alike to capitalize on this trend by creating cutting-edge applications tailored to evolving consumer needs.

Secondly, advancements in mobile technology have created a favorable environment for fintech app development. More than half of all internet traffic originates from smartphones and tablets, which makes building mobile-first financial solutions imperative. Mobile devices are becoming ever more powerful and capable of delivering complex computing tasks seamlessly. Growth in cloud computing and related infrastructure improvements further facilitates scalable fintech app development while reducing costs.

Another key factor driving fintech app adoption is shifting consumer preferences toward simplified and streamlined experiences. People desire faster, safer, and more efficient ways to manage their finances digitally. This presents a perfect opportunity for fintech app developers to address real pain points within traditional banking systems and offer innovative alternatives that meet these expectations head-on.

Lastly, working with a reliable fintech app development company offers numerous benefits that can accelerate success in today’s dynamic landscape. Outside experts bring specialized knowledge, proven methodologies, and valuable connections to your project. Collaborating with skilled professionals increases the chances of producing high-quality software products that attract and retain users.

As these compelling arguments demonstrate, the timing could not be better to embark upon a fintech app development venture with a trusted Fintech app development company.

Wrap Up

Overall, the rapid evolution of FinTech and open finance promises new opportunities for entrepreneurs, investors, and consumers alike, creating a more connected, accessible, and secure global financial marketplace.

While this transformation requires ongoing effort in balancing innovation with responsible regulation, its long-term impact will likely redraw the boundaries of conventional financial systems, promoting greater efficiency, transparency, and fairness for society.

In conclusion, taking advantage of the above factors ensures you remain ahead of competitors, cater to growing customer demands, leverage emerging technologies, benefit from external expertise, and ultimately increase your likelihood of achieving commercial success in the exciting world of fintech apps.

Connect with SolGuruz to design and develop a fully functional, secure, and reliable Fintech mobile application for your financial institute or services.

FAQs

1. Why Is Fintech App Development Gaining Popularity?

Fintech application development is gaining immense popularity for the following reasons: Convenience, Cost-effectiveness, Accessibility, and Personalization.

2. What is the Process for Fintech App Development at SolGuruz?

While we develop a Fintech mobile application for your business or organization, we have a standard process that includes requirement gathering, design, technology selection, development, testing, deployment, and support.

3. How to Hire Mobile App Developers for My Fintech App?

Well, you can hire the best Fintech experts from SolGuruz by scheduling a call with us online. We will help with the interview process of our developers, where you can select the most suitable mobile developer for your project. Later, we can discuss the rates and deadlines and start with the development process.

4. How Can I Ensure a Seamless User Experience in a Fintech App?

We follow practices such as user-centric design, streamlined navigation, personalization, security and seamless integration for delivering an excellent user experience.

From Insight to Action

Insights define intent. Execution defines results. Understand how we deliver with structure, collaborate through partnerships, and how our guidebooks help leaders make better product decisions.

Develop Your Fintech Solution

Revolutionize financial services with our cutting-edge fintech solutions. Speak to our experts to start your project today.

Strict NDA

Trusted by Startups & Enterprises Worldwide

Flexible Engagement Models

1 Week Risk-Free Trial

Give us a call now!

+1 (724) 577-7737